This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

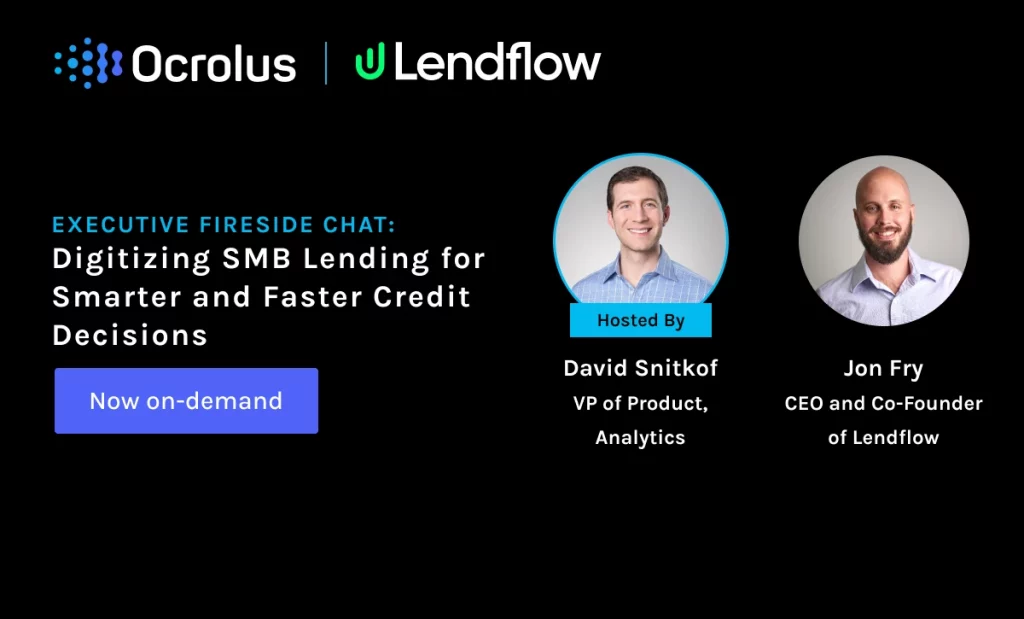

Executive Fireside Chat: Digitizing SMB Lending for Smarter and Faster Credit Decisions

Now available on-demand

Small businesses need responsive access to credit. They often don’t have the time to wait for lengthy loan approvals or meticulous manual data review. Automation is stepping in to fill the gap and allow lenders to make smarter and faster credit decisions. By utilizing embedded lending technology, lenders can automate their manual and time-consuming tasks, drastically cutting underwriter review time per file. As featured speaker Jon Fry said, “for lenders, it’s more about changing the ways things are done and embracing new processes, rather than fighting against them.”

In this fireside chat, Ocrolus VP of Analytics David Snitkof chats with Jon Fry, CEO about digital disruption and what it really takes to be a responsive SMB lender. Much of the discussion is focused on embedded technology, and the way lenders need to make technology a key part of their workflows rather than just a supplement.

What you’ll learn:

- How technology can help reduce friction and bottlenecks in the lending process

- Hear what digital disruption means for lenders and borrowers alike

- Discover the latest technology being used for digitizing the lending process – from onboarding to underwriting

- See how Lendflow is disrupting lending and democratizing access to credit