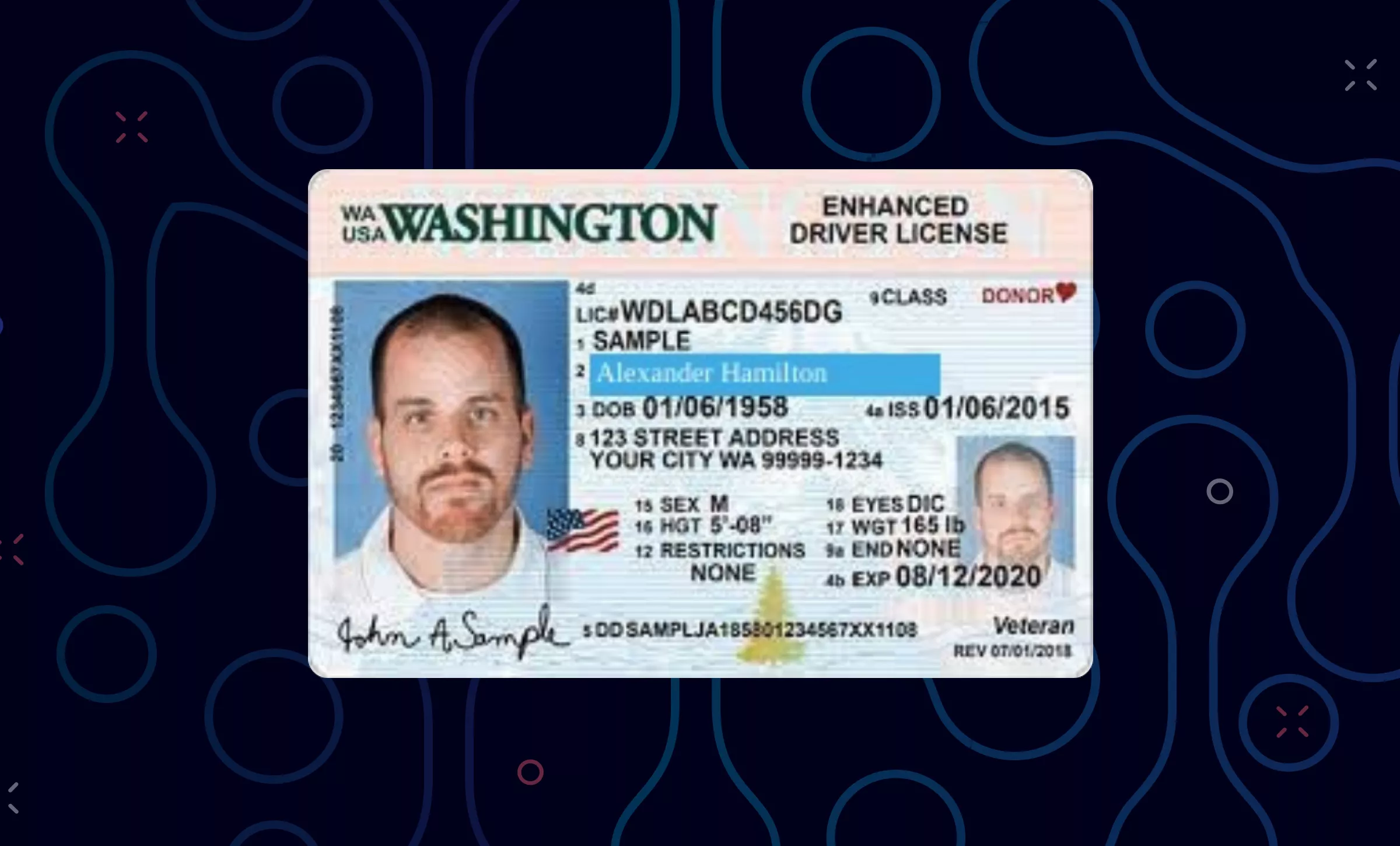

Quickly and accurately extract data from driver's licenses to verify ID faster

Ocrolus’ Human-in-the-Loop document automation solution captures and extracts data from driver’s licenses, enabling you to verify ID in real-time, process loans faster, and detect fraudulent applications.

Why should lenders use Ocrolus for driving license data capture and form processing?

Loan underwriters process driver’s license data to verify a borrower‘s identity. The layout and template for driver licenses vary based on their state or country of origin and license data is often delivered in multiple file formats through different sources, such as email and mobile apps. This poses a challenge for regular OCR solutions, and without a reliable intelligent document processing solution, lending professionals spend hours manually processing drivers’ license data. This can lead to human error, which delays ID verification and loan approval.

Ocrolus’ automation solution lets you capture, review, analyze, and download data in real-time from driver licenses delivered in multiple formats. It rapidly processes hundreds of driver licenses with 100% accuracy and cuts costs by 70%.

Advantages of Ocrolus’ automated driver license processing

Retrieve data from driver licenses regardless of format or quality

- Verify borrower ID in real-time

- Cut turnaround time

- Process multiple driver licenses with high accuracy

- Cut costs by 70%

Ocrolus' document processing stats

financial pages analyzed

documents flagged for suspicious activity

business loan applications analyzed