Empower your underwriting team with a better way to process credit score disclosures

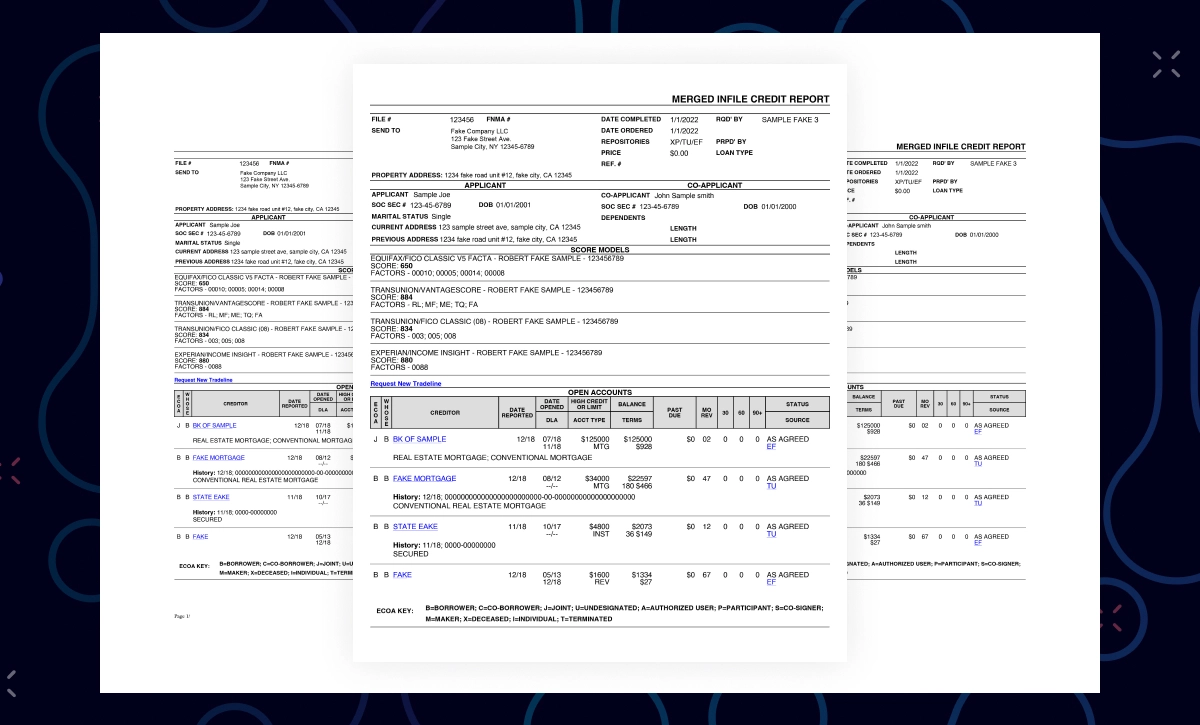

Ocrolus’ Human-in-the-Loop document automation solution captures and extracts data from credit score disclosures to help you make faster knowledge-based lending decisions.

Why should lenders use Ocrolus for credit score disclosure data capture and processing?

Loan underwriters process credit score disclosure data to help verify an individual or organization’s financial history and status. This form is often delivered in multiple file formats through different sources, such as PDFs, Word docs, and hard copies, and the quality of the text on the form can be poor. This poses a challenge for traditional OCR solutions, and without a more reliable and integrated intelligent document processing solution, lending professionals can spend hours manually processing credit score disclosure data. This tedious chore can lead to a rise in human error rates, which can consequently delay loan approvals or even lead to loan rejections.

Ocrolus’ automation solution lets you capture, review, and analyze data from credit score disclosures in real-time. It ensures that critical credit score data is accurately captured and aids faster data-driven decisions.

Advantages of Ocrolus’ credit score disclosure processing

Retrieve data from credit score disclosure documents regardless of format or quality. Ocrolus helps you:

- Cut turnaround time

- Process multiple credit score disclosure documents with over 99% accuracy

- Quickly verify a customer’s financial history

- Reduce the risk of fraud

Ocrolus' document processing stats

financial pages analyzed

documents flagged for suspicious activity

business loan applications analyzed