vs Ocrolus Automation

Go beyond OCR with a Human-in-the-Loop, document processing & automation solution

About Ocrolus

Ocrolus is an intelligent document automation software with Human-in-the-Loop validation along every step of the process. We help companies review and process millions of pages of financial documents every month. Unlike traditional OCR, the Ocrolus solution can capture any field, on a broad set of document types – regardless of the format or quality – and transform it into decision-ready data, helping businesses process documents more accurately & quickly, saving money and time while enabling scale.

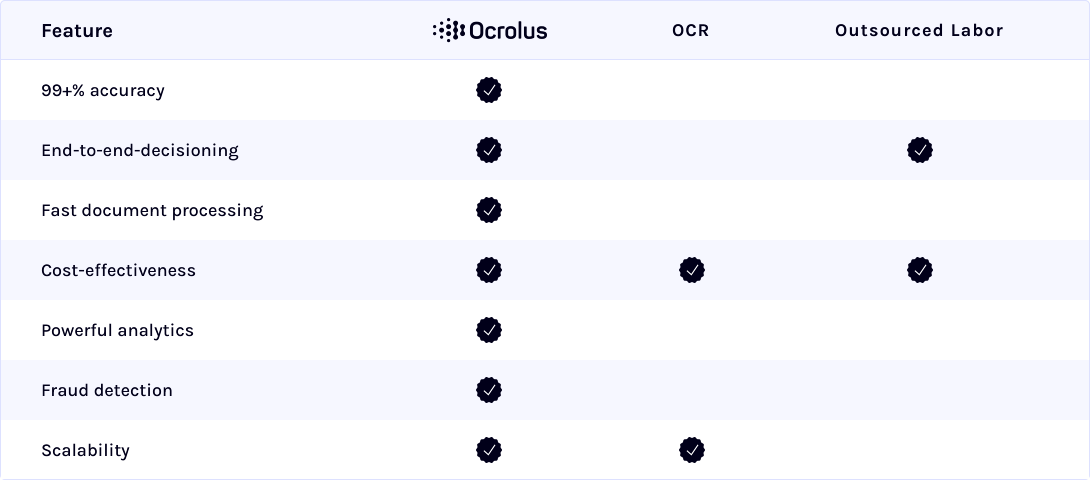

Key benefits of choosing Ocrolus as your intelligent data capture solution vs traditional OCR

Traditional OCR providers offer limited efficiency and accuracy while Ocrolus boosts accuracy and improves decision making with a full Human-in-the-Loop verification service.

- OCR offerings are not quite turnkey products, as they require manually training the system to use templates for different formats.

- OCR services do not include human validation, so clients must retain or outsource internal verification functions to correct data inaccuracies.

How can Ocrolus help?

Digitize Documents

Go beyond traditional optical character recognition (OCR) and business process offshoring (BPO) workflows with Ocrolus’ best-in-class “Human-in-the-Loop” document analysis process.

Decide With Better Data

Make smarter decisions with Ocrolus’ cutting-edge cash flow analytics and other alternative data sources.

Detect Fraud

Identify fraud with Ocrolus’ powerful document-level fraud analysis tools. Take advantage of built-in arithmetic checks, tampering detection technology, and a business intelligence network of hundreds of lenders to automatically flag suspicious documents, missing pages, and digitally altered data.

Ocrolus elevated our bank statement capabilities to the next level.”

What types of documents does Ocrolus process?

Process and extract data from any image or document with over 99% accuracy

- Bank statements

- Paystubs

- IDs

- Tax documents

- Mortgage forms

- Invoices

What industries does Ocrolus service?

Intelligent data capture solutions for:

- Banks

- Fintechs

- Mortgage lenders

- Accountants & auditors

- Professional services

Ready to go?

Discover how Ocrolus can solve your data capture and document review challenges.