This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

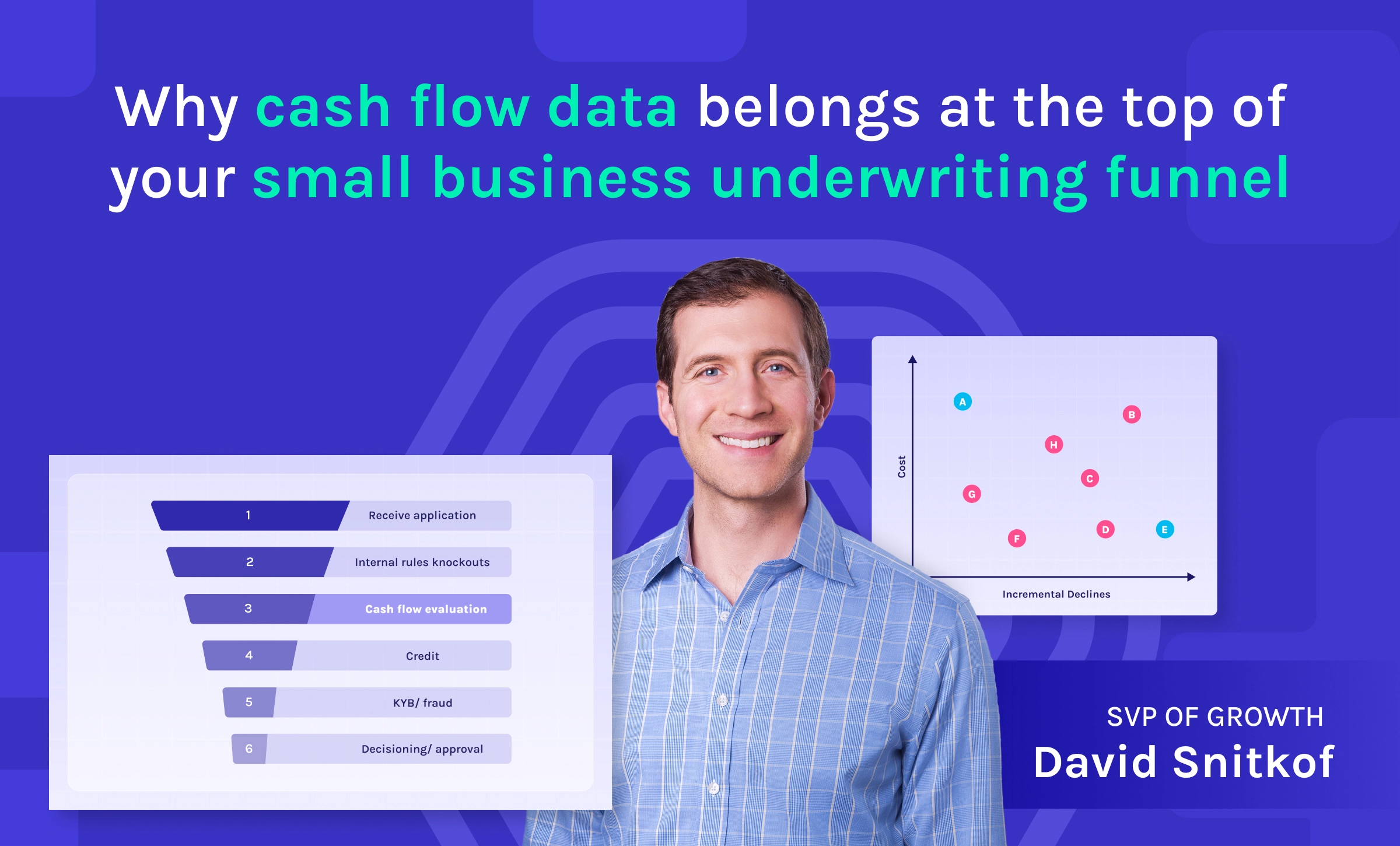

Flipping the funnel: A cash flow-first approach to SMB underwriting

Did you miss the live session? No problem!

You can access the full recording on demand, in which Anneika Patterson, Director of Product at Ocrolus and Herk Christie, COO of Expansion Capital Group, discuss how small business funders can leverage cash flow analysis as a primary step in the underwriting funnel to minimize costs and improve funding outcomes.

In this session, you’ll learn:

Why a cash flow-first approach can create a more complete picture of small businesses’ financial health

How AI-driven automation streamlines cash flow analysis to filter out unqualified applicants early

Key advantages of cash flow-first underwriting including cost savings, improved approval rates and a better customer experience

Steps to assess and transition your underwriting process to prioritize cash flow data

Join us to discover how a cash flow-first approach can optimize your underwriting process, reduce operational expenses and effectively position your organization to fund more qualified customers.