This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Fraud Detection: A Lender’s Ultimate Guide

Fraud detection includes both a manual and automated review to check documents for falsified information.

Fraudulent documents in loan applications expose lenders to default risk and increase the potential for loss. In fact, 5% of loan applications contain falsified documents, which are not readily detected by manual review.

Legacy review of loan documents is slow, costly and prone to human error. By contrast, machine learning artificial intelligence (AI) offers an automation solution to detect document tampering and flag loan applications for closer review.

This guide provides an overview of fraud detection and prevention best practices. It includes discussing the most common types of fraud and what lenders should look for when processing loan applications. This overview will also help lenders understand how fraud detection AI and automation tools can be used to identify documents that may have been altered or forged.

What is fraud detection?

Fraud detection includes both a manual and automated review to check documents for falsified information. Lenders review documents for fraud as part of their due diligence on loan applications. Automation solutions use machine learning artificial intelligence to scan documents automatically for fraud.

For example, Detect, the built-in document fraud detection AI tool in the Ocrolus platform, can identify and contextualize fraudulent activity. The results are accessible to lenders via an easy-to-use dashboard on the front end. This facilitates human review to confirm file tampering.

Fraud detection AI enables lenders to determine if a loan application includes false information or documents that have been altered using a downloaded template. Detect works on native PDFs, enabling lenders to automatically review documents such as bank statements, pay stubs, and W2s.

What is the difference between fraud detection and fraud prevention?

The difference between fraud prevention and fraud detection relates to how and when security measures are implemented. Fraud prevention tools are part of the loan origination process. These tools enable users to take proactive steps to ensure receiving accurate loan-related data. Whereas, fraud detection tools come into play after a loan application is received. The use of AI technology supports automation for analyzing documents in real time. This enables the detection of data and documents that may have been altered.

Why is fraud detection important?

Fraud detection is important for minimizing the costs associated with investigating, recovering, and writing-off bad loans. According to a LexisNexis study, every dollar in fraud loss costs financial services firms $4. Moreover, a CoreLogic study found, nearly 1% of mortgage applications contained fraudulent information in 2021.

Fraud is not limited to mortgage loans. A Nice Actimize report found that fraud attempts in the banking industry rose 41% in 2021 over the previous year. Moreover, the Small Business Administration reported that millions of dollars in relief funds were obtained fraudulently from the Paycheck Protection Program (PPP).

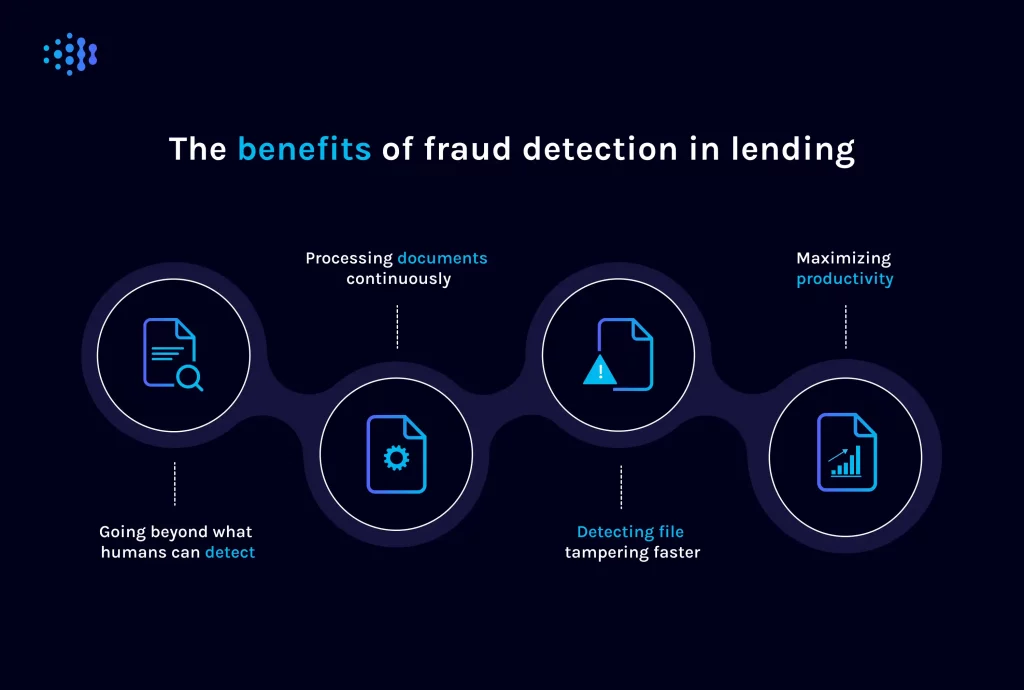

What are the main benefits of fraud detection in lending?

Detecting mortgage lending fraud can be extremely difficult. Even when mortgage lenders know the risks, manual review of numerous documents makes identifying fraud very difficult. Automation and AI provide four key benefits for lenders, including:

- Going beyond what humans can detect

- Processing documents continuously

- Detecting file tampering faster

- Maximizing productivity

What are the red flags of fraud?

Several signs in loan applications can serve as red flags for potential fraud. These red flags may include:

- Spelling and applicant address discrepancies are common indicators of file tampering.

- Documentation that includes deletions or other obvious alterations requires careful scrutiny.

- Verifications that have been fast-tracked or completed outside of normal business hours are another sign of potential fraud.

- An excessive number of automated underwriting system submissions is another red flag.

Fraud detection AI automation systems can identify questionable documents more quickly and accurately than manual processes. This gives lenders the ability to harness the power of AI so a human expert can review suspicious documents for potential fraud.

A recent study by Ocrolus found that using machine learning artificial intelligence in fraud detection helped lenders identify 20% more fraud than conventional reviews. Automation also shortened review time by 30 minutes per application—reducing loan processing overhead for lenders.

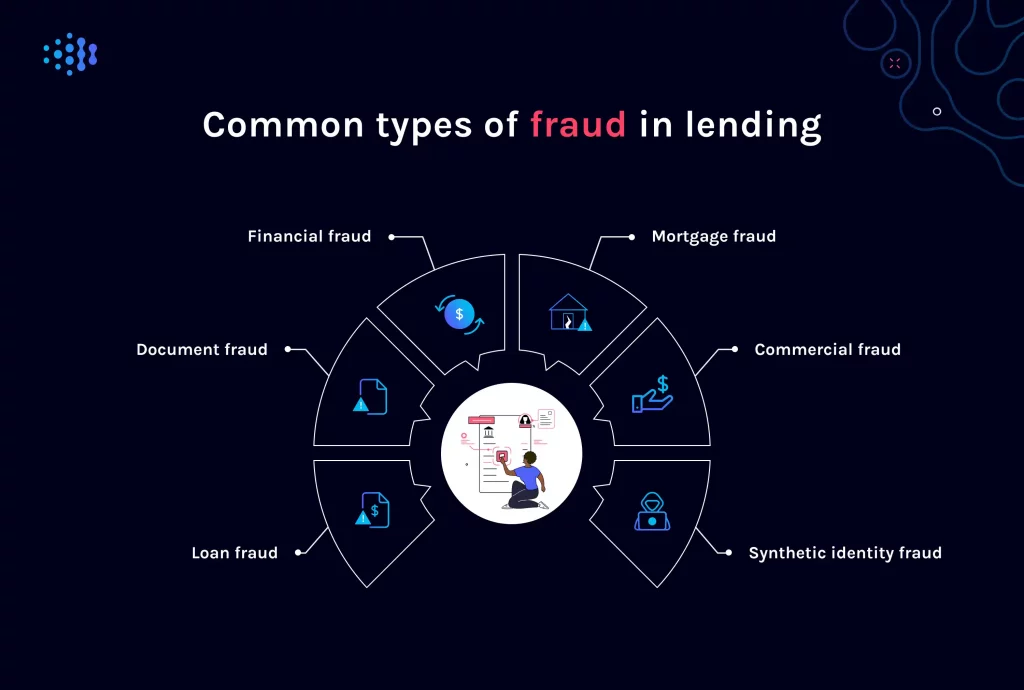

Most common types of fraud

Fraud in lending encompasses various strategies used by consumers, criminals, and sometimes even insiders at financial institutions. The most common are loan fraud, document fraud, mortgage fraud, commercial fraud, and synthetic identity fraud.

Loan fraud

Loan fraud is a form of identity theft in which a bad actor uses a stolen identity to obtain a loan. This type of fraud is marked by an imposter using a person’s social security number, bank account number, and other personal information on a loan application. Inconsistencies and mistakes on loan applications are ways in which potential loan fraud can be identified during the lending process lenders can identify potential loan fraud.

Document fraud

Document fraud attempts to secure a loan using fake or altered documents. This can range from documents that have been altered to complete forgeries. Financial institutions may, for example, receive documents in which the data has been changed. More sophisticated document fraud often involves creating complete fakes using downloaded templates. Document fraud also includes using legitimate documents by someone impersonating the borrower. Errors and inconsistencies with font usage and formatting are ways document fraud can be identified as part of loan application due diligence.

Financial fraud

Financial fraud occurs when a criminal steals money or other assets through deception. This can range from embezzlement and identity theft to document fraud and mortgage fraud. Lenders can find evidence of financial fraud from accounting anomalies or inconsistencies in borrower data, such as when a social security number does not match the applicant’s name or address.

Mortgage fraud

Mortgage fraud entails using falsified information to obtain a mortgage or a larger loan amount than would be approved based on the true data. This often is reflected by false information on a mortgage application. Fraud on the consumer level is often used to acquire a house or to manipulate a property’s appraised value. Another type of mortgage fraud results from industry insiders, such as bank employees or attorneys, using the process to bilk homeowners or lenders. Documents that appear to have been altered or that contain data discrepancies are signs of mortgage fraud.

Commercial fraud

Commercial fraud includes deceptive practices and/or legal violations committed by business executives for financial gain. Commercial fraud ranges from misleading statements about corporate performance to failure to disclose income on business tax returns. This type of fraud generally presents itself in lending as misrepresentations of facts and/or borrower information.

Common examples of commercial fraud include misappropriation of business funds, false statements about a company’s financial performance, kickbacks from third parties to influence a loan decision, and insider trading.

AI automation can improve a lender’s commercial fraud detection capabilities by making it easier to identify data and transaction anomalies. Automated review is faster and more accurate than manual processes. Machine learning artificial intelligence can be trained to handle commercial loan due diligence based on each lender’s specific needs and compliance requirements. Automation can compare loan applications to large data sets in real-time and flag suspicious transactions for further review.

Synthetic identity fraud

Synthetic identity fraud is a growing problem as criminals create fake identities by either manipulating stolen credentials or creating new identities using fragments of personally identifiable information. On a loan application, a synthetic identity might, for instance, include a valid social security number associated with a real address. But, upon closer inspection, the address, social security number, applicant name, and date of birth will not match a real person. While synthetic identity fraud is often hard to detect, comparing loan application information to third-party data can reveal discrepancies that were introduced as the result of fraudulent activity.

A synthetic fraud detection solution can help lenders use big data to implement know-your-customer (KYC) best practices, such as verifying the identity of a loan applicant and reviewing supporting documentation for inconsistencies. Due diligence requires the ability to process and analyze documents quickly and efficiently. Machine learning algorithms enable lenders to automate workflows, extract data from documents, and analyze that data for accuracy.

What types of documents can fraud detection automation be used for?

Fraud detection AI solutions can automate reviewing of many loan documents, including bank statements, paystubs, W2s, tax forms, mortgage statements, driver’s licenses, and other personally identifiable information. Machine learning enables these types of documents to be automatically parsed, processed, and analyzed.

Fraud detection tools and techniques

AI-powered fraud detection solutions can streamline underwriting workflows for lenders, from automated fraud detection to detailed cash flow analytics. Automation reduces tedious manual tasks while enabling lenders to scale loan processing capacity in response to increased demand. Machine learning also increases accuracy and removes much of the human error from the due diligence process.

Detect fraud with Ocrolus

The goal of Detect is to proactively identify questionable documents to streamline review processes. The AI-based platform uses machine learning and an unrivaled document dataset to scan documents and return highly accurate, decision ready data to help minimize risk and prevent costly losses. Detect returns findings in the form of a document Authenticity Score, file tampering signals and file tampering visualizations. Lenders can access all of this through an interactive, web based Dashboard and via API.

Detect evaluates a document’s origin and inspects it for signs of tampering after creation. Detailed signals outline exactly what has been changed on the document, helping lenders identify things that are likely to be missed during manual review. Clear file tampering visualizations illustrate precisely where tampering has occurred and can even display received documents next to the original document before it was tampered, making it easy to uncover what fraudsters have tried to conceal. All of this important information is distilled into a single, easy-to-interpret Authenticity Score. This single score allows users to build tailored workflows and streamline decision making with greater certainty.

Uncover potential document fraud faster

Detecting fraud at scale improves the accuracy of loan due diligence and saves time and money for lenders. Machine learning models enable lenders to use AI to identify trends in data and documents. Automatic document review facilitates the ability to quickly flag documents that may be fraudulent. This includes detecting document tampering based on abnormalities or missing data. Automation can help lenders identify numerous types of fraud, from loan fraud and financial fraud to document fraud and mortgage fraud.

Detect, AI-based the document fraud detection solution developed by Ocrolus, includes algorithms that have been trained on hundreds of millions of documents from thousands of financial institutions, giving lenders the ability to make lending decisions based on high-quality data analysis. With highly accurate insights, lenders can learn more about a document’s origin and determine whether it can be considered authentic, helping them reduce risk and streamline their document review processes.

Identify fraud faster and more accurately with Detect: Book your demo.