This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

What is fraud risk and how can it be reduced?

Managing risk in lending with AI-driven document automation

Regardless of industry, every organization faces risks related to fraud. However, with the growing prevalence of online criminal activity, financial institutions and lenders have experienced a notable uptick in fraud risk compared to other sectors.

Fueled by the pandemic, digital transaction volume has rapidly increased in the last few years. According to a 2022 LexisNexis study, online and mobile channel transaction share is now on par with or exceeds in-person transactions, with U.S. credit lenders and investment firms seeing the largest growth.

At the same time, fraud costs are rising for U.S. and Canadian financial service firms – up 19.6% – 22.4% compared to 2020 – with banks reporting the highest average of $4.36 for every $1 of fraud loss.

By prioritizing fraud prevention and investing in advanced technology such as AI-driven document automation, financial institutions can detect potential fraud faster and prevent costly losses while making more confident lending decisions.

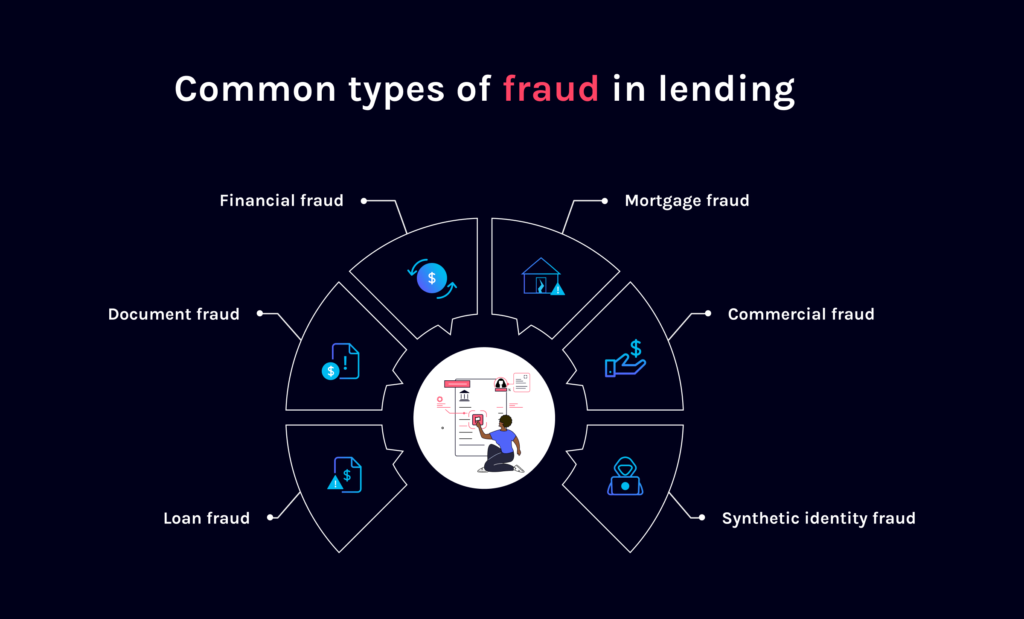

Types of fraud to look out for

As lenders work to understand and manage their fraud risk, it’s a good idea to be aware of several types of fraud that could damage their organizations.

Types of fraud include:

Financial fraud. Often committed through identity theft, phishing scams, or unauthorized transactions, financial fraud occurs when someone steals money or other assets. This can include manipulating accounts, documents or loans for financial gain.

Loan fraud. A form of identity theft, loan fraud is committed when a loan is illegally obtained by using another person’s social security number, bank account number, and other personal information on an application.

Mortgage fraud. Mortgage fraud occurs when false information such as fake pay stubs is used to obtain a mortgage or a higher loan amount than what would be approved with accurate data.

Document fraud. Document fraud is when criminals forge a document, alter an existing document to change details, or provide a stolen document in an effort to secure a loan an applicant would otherwise not qualify for.

Synthetic identity fraud. One of the fastest-growing types of financial fraud, synthetic identity fraud, is committed when a loan is secured by a fake persona. These synthetic identities combine real data, such as a Social Security number, with false information, such as a phony name and address, and are often hard to detect without comparing against third-party data.

Download the free guide | Spotting the fraud on key lending documents: Top signs to look forHow can fraud risk be managed?

While there are numerous ways financial fraud can be committed and the risk of fraud is rising, solutions are available to help lenders better assess, manage and reduce fraud risk.

The first step is to evaluate your organization’s risk of fraud. Because every organization has a different risk profile or risk tolerance, your risk assessment must be tailored to your organization.

Your risk assessment must include numerous areas of your business, analyzing and describing the fraud risks and how likely they are for those risks to occur in each area.

After analyzing your organization’s fraud risk, consider the importance of that risk to the business and identify internal controls to prevent those risks from occurring, decide who will maintain those controls in each area, and establish regular monitoring to ensure effective fraud risk management.

How does AI-driven document automation help detect and reduce fraud?

In addition to conducting a fraud risk assessment to understand the risks facing your organization, numerous tools and lending technologies are available to help mitigate fraud risk.

For example, AI-driven document automation technology empowers lenders to streamline the underwriting process while improving the accuracy of loan due diligence.

Detect, Ocrolus’ fraud detection capability, helps lenders identify document fraud and reduce the risk of costly losses down the line. Powered by machine learning models, Ocrolus enables lenders to automatically identify trends in data and documents and flag fraud or abnormalities like missing information.

Continuously learning, Detect’s algorithms have been trained on more than 100 million pages of documents from thousands of financial institutions, providing lenders with only the highest quality data for more confident decision-making.

From here, clear visualizations help illustrate exactly where a document has been tampered with or where an error occurred on a file – helping bring more than 4 times more fraud to your attention than other solutions.

Takeaways

- Fraud risk in lending is on the rise as a result of increased digital transactions

- The 5 types of fraud to look for: 1-5

- Document automation can help reduce your fraud risk by: streamlining underwriting processes, improving due diligence accuracy, and training machine learning to your needs

Ready to uncover potential fraud faster?

Book your demo to discover how Ocrolus empowers lenders to quickly and confidently approve more borrowers while easily identifying potential signs of fraud.