This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Tag: lending automation

Why consistency and integration are must-haves across mortgage lending technologies

Document automation is reshaping the future of mortgage lending every day. This AI-driven technology offers a significantly improved customer and employee experience by enabling faster and more accurate decisions through data-driven insights. However, lenders can experience challenges integrating this technology into their workflows if platforms are not integrated and can address inconsistencies across an applicant’s various documents. To effectively improve mortgage lending processes, companies must ensure seamless data integration throughout their technology stack to stay ahead of the curve. The role of document automation in enhancing mortgage lending processes Document automation is a game-changer in mortgage lending, mainly when dealing…

Working with Partners to Transform the Fintech Ecosystem

Part of what first attracted me to Ocrolus was the opportunity to work for a company that is making financial services fairer, more accessible, and more transparent. In addition, I figured that managing partnerships for Ocrolus would give me the opportunity to utilize many of the skills I had learned as a venture capital investor at Argo and Andreessen Horowitz (a16z) and as an institutional investment analyst. That was over two years ago. Today, I’m happy to report that new partnerships are helping drive growth at Ocrolus, and I’m excited to be part of a fintech infrastructure company that uses…

How Automation Can Help Organizations Support Remote Workforces

Financial services companies are dealing with the impact of the clear and permanent shift to a hybrid workforce model. The changes have actually been a long time coming, and so the tools to support these new models are more mature than many realize. Pre-pandemic, financial services were already pioneers in hybrid environments. According to Owl Labs survey data, financial services was the #3 leading industry to embrace hybrid work, behind only healthcare and high tech. And PwC’s 2019 Remote Work Survey showed that more than one-quarter of financial services companies let the majority of their workforce work remotely at least…

In the Loop: New Models for Fraud Prevention Part 1

Four fintech leaders discuss key issues in addressing financial fraud PART I Welcome to this recap of the Ocrolus virtual roundtable discussion on financial fraud and fraud prevention. Ocrolus’ Head of Analytics David Snitkof leads a lively discussion with Nicole Hill, Head of Consumer Bank & Shared Services Risk Oversight with Citizens Bank, Naftali Harris, co-founder and CEO of Sentilink, and Kyle Mack, CEO and co-founder of Middesk. This week we’re presenting part one of their conversation. Part 2 will be posted next week. David Snitkof: There’s so much happening in the world of financial technology, but one thing is…

Account Takeover Fraud: What Online Lenders Should Know

Account takeover (ATO) is on the rise, in fact, in 2020, over 1 in 3 people (38%) in the US had been affected by account takeovers. This rising statistic could be bad news for lenders as it could mean account takeover fraud is also on the rise. While account takeover fraud isn’t new, its growing proportion of fraud losses indicates that lenders, and others, should take note and start devoting more resources to detecting and preventing it. What Is Account Takeover Fraud? Account takeover fraud is a form of identity fraud in which a fraudster uses an individual’s compromised account…

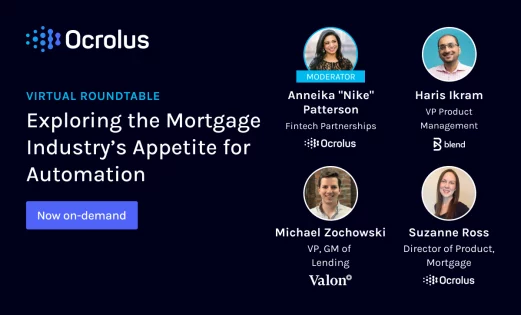

Virtual Roundtable: Exploring the Mortgage Industry’s Appetite for Automation

Now Available On-Demand As mortgage rates continue to rise, lenders will need to do all they can in order to stay competitive. Historically, mortgage lenders have been reticent to adopt new technologies, citing a lack of trust and transparency. Furthermore, the effort involved with onboarding new processes can quickly become overwhelming. As panelist, Haris Ikram, put it, “in any industry, change management is really hard,” but change may become more of a necessity for lenders wishing to retain profitability in a shrinking market. In this virtual roundtable, leading mortgage experts from Blend, Valon, and Ocrolus delve into exactly what makes…