This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

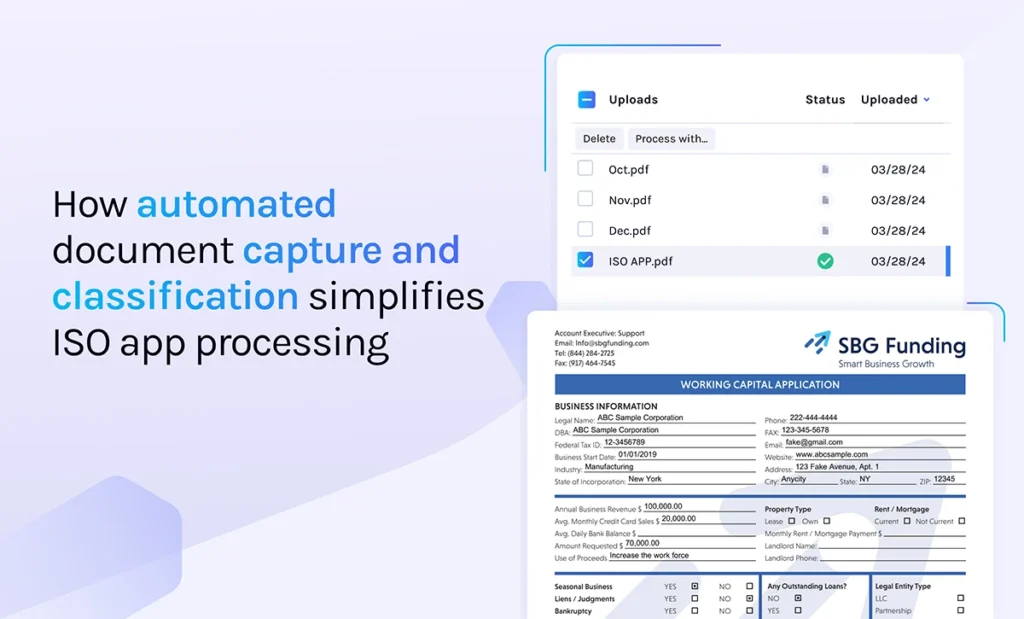

How automated document capture and classification simplifies ISO app processing

Independent Sales Organizations (ISOs) fill crucial roles in the small business financing market.

Acting as intermediaries to connect companies seeking capital with lenders and financial service providers, ISO applications offer detailed insights about small businesses applying for funding, enabling lenders to assess a borrower’s suitability for a loan.

Small business lenders can significantly streamline their evaluation process at the top of the funnel by prioritizing efficient review of ISO applications. This efficiency at the start sets the stage for smoother document handling downstream—as long as lenders have effective processes in place.

Challenges in manual ISO application review

The first challenge with ISO applications is how they are submitted. The variety of submission methods can complicate traditional review, particularly in the early stages. This makes it hard to maintain consistency and speed in top-of-funnel decision-making.

Lenders can spend hours manually entering and reviewing data from multiple ISO applications without a reliable, intelligent document automation solution, increasing the risk of human error. In an industry where speed and reliability are not just valued but directly tied to profitability, these delays can be particularly costly, affecting both the lender’s operational efficiency and the borrower’s experience.

How to automate ISO applications across various formats

Document automation solutions enable lenders to quickly capture, review and analyze application data from various formats, including digital uploads, email attachments and scanned documents. By streamlining ISO application processing with document automation, small business lenders can significantly reduce the time and resources traditionally required for loan processing.

For example, Ocrolus accelerates the ISO application process by enabling lenders to quickly capture, review, and analyze data from multiple formats in real time.

By rapidly and accurately processing ISO application data, Ocrolus enables small business lenders to assess applicants’ creditworthiness quickly and confidently against their internal lending criteria, improving the borrower experience.

Document processing for SMB lending efficiency

Ocrolus equips lenders with the speed and convenience of ISO app processing through our rapid machine-only document processing capabilities. As lenders move to accompanying forms and uploads, Instant Classify provides fully automated efficiency throughout the document processing workflow.

This process allows lenders to make quicker, more informed top-of-funnel decisions based on ISO information while providing flexible, cost-effective workflows for processing additional submitted documents.

Ocrolus’ Complete offering also includes Human-in-the-Loop (HiTL) verification for lower-quality documents provided by borrowers that might require more scrutiny. This combination allows for machine and human verification, simplifying and fully automating the document analysis process with over 99% accuracy.

Ocrolus eliminates the guesswork by automatically directing documents to a machine-only or HiTL workflow based on the document’s quality and confidence score. This system ensures that every document is processed using the most appropriate method for accuracy, reliability and confidence throughout the decision-making process.

ISO apps are critical to small businesses seeking capital and lenders assessing their creditworthiness. Efficiently managing these applications is essential.

AI-powered document automation technology like Ocrolus enables lenders to accelerate the initial stages of the small business lending process by swiftly capturing, reviewing and analyzing ISO application data in various formats.

By streamlining ISO application processes, lenders can significantly enhance their initial evaluation phase, setting a foundation for smoother, more efficient document handling throughout the rest of the process.

Book your demo to learn how Ocrolus’ AI-driven document automation can help small business lenders streamline their top-of-funnel workflows.

Key takeaways

- Machine-only document capture and classification help automate ISO application processing, significantly improving the efficiency of top-of-funnel decision-making.

- AI-powered document automation coupled with Human-in-the-Loop verification enhances accuracy and decision-making at the top of the funnel, ensuring a streamlined loan processing workflow.

- Lenders can eliminate manual processing challenges and human error by automating ISO application review, leading to faster loan approvals.