This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Lending After Lockdown: How Small Businesses Can Improve Their Creditworthiness: Perspectives from Lendio, Cross River Bank, Kapitus and Ocrolus

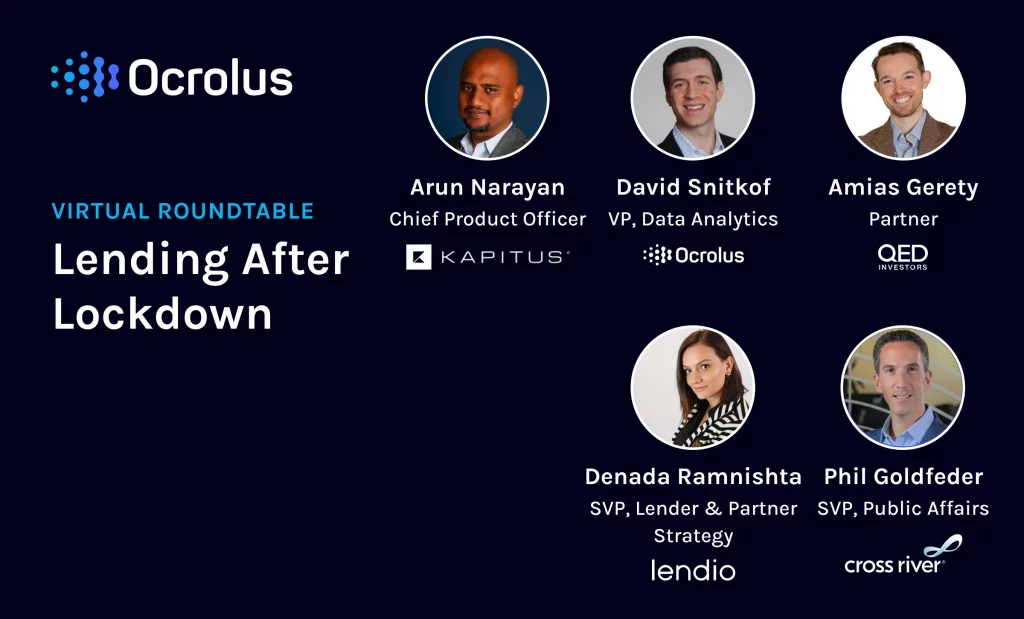

Five fintech and small business funding experts came together on August 11 to discuss the future of small business lending post-Covid. Hundreds of attendees joined the virtual roundtable to learn how agile lenders are setting new standards for small business funding.

The live event, moderated by Amias Gerety, Partner at QED Investors and former President’s nominee and Acting Assistant Secretary for Financial Institutions at the U.S. Department of the Treasury, included a panelist of industry thought leaders: Arun Narayan, Chief Product Officer at Kapitus, Denada Raminshta, SVP of Lender & Partner Strategy at Lendio, Phil Goldfeder, SVP of Public Affairs at Cross River Bank, and David Snitkof, VP of Analytics at Ocrolus. They discussed the role of technology in a time of crisis, how to address SBA’s PPP loans and fraud prevention, and simple strategies to ensure sustainability amidst uncertainty.

In this blog, we revisit just one of the many interesting topics the panelists chewed over. Read the advice Amias, Phil, David, Denada, and Arun shared on how small businesses can improve their creditworthiness now.

Key advice for small businesses:

- Lightly pivot your business model to maintain cash flow.

- Have a story to tell around how you are navigating through the current crisis.

- Preserve your capital and take advantage of every program available.

Note: This transcript has been slightly modified for readability.

Amias Gerety, QED Investors: From a lender’s perspective, are there things tactically that a business could do to improve the signal extending to lenders here? I don’t know if anyone has ideas. I’d love to see if we can give a little bit of tactical advice to businesses, or people in the ecosystem, as they think about improving their creditworthiness.

David Snitkof, Ocrolus: I would start by almost jokingly, but not jokingly, say you change your industry and change your geography. Not to say that you should move or get into a different business, but we’ve actually seen some small businesses doing a light pivot, which has helped them maintain cash flow during this time.

People who have been doing in-person retail sales are very quickly pivoting to e-commerce. It’s easier than ever to say, “all right, now I’m going to open a Shopify store”, and I can pivot to e-commerce. If people couldn’t do business unless the customer was walking in the door, now in essence can change their geography by offering things to people online and shipping. Obviously, not every business can do that. But it is changing your industry and geography, even a little bit, if something that’s possible.

The other thing to do if you’re a small business, is to do everything you can do to be creative and flexible. If you think about the stimulus to the country, part of it is, can you finance the country getting through this terrible period, so that we’re in a position to come out on the other side? Even if you have to spend a massive amount of capital in order to do so, you want to do that in order to provide people the security and the mental security of being able to stay at home and do all the things they need to do, so we can be healthy coming out the other side.

The same is true for a business. Getting access to whatever capital you have and taking steps to preserve the capital you have. Try to draw down spending as much as possible, take advantage of every program out there, and figure out every way to make extra revenue because there is no fixed end date to this pandemic. The more you can bolster your cushion, the better shape you’re in. Then, of course, if you’re applying for funding to a lender, the more you can do to actually demonstrate that, one, you have a sufficient capital cushion, and two, you have your hands on the controls of your business, such that you can pivot nimbly if you need to. I think that goes a long way, particularly if you’re applying to a lender that has the ability to ingest and make sense of that data.

Phil Goldfeder, Cross River Bank: I was watching the news a few months back, where someone had his entire inventory wiped out, and preparing for a big weekend, repurchased all his inventory and spent a tremendous amount of money, only for there to be a downturn. Once again, a week later, he was talking about the second inventory getting wiped out.

I think it’s about small businesses being honest about what the situation is that they’re being confronted with. I think oftentimes in the lending space, we try to force that when making the lending decision and looking at underwriting information, we’re trying to dig down to what’s common sense here, and that you have to be realistic about what the outlook is. While most of us are hopeful that the pandemic is over in a few weeks, and life goes back to normal, it’s just simply not the case. I think the last five months, if proven nothing else, have proven that it’s not two months, it’s not three months, or four months, and quite frankly, we don’t know, and you have to prepare. I think everybody thinks like, great we can be reopened again next week. Let me refill my entire inventory, and we’ll have a great weekend, and all is back to normal. I think this is going to be a slow burn, and it’s going to be a slow process of coming back. There’s no such thing as turn the key, and the engine is revving again. I think people have to be realistic about what that would look like.

Amias Gerety, QED Investors: Yeah, and in many ways, it’s actually harder to run a business at 80% capacity than it is to hibernate a business with the doors closed.

Denanda, you’re on the front lines here. You’ve got businesses walking through the doors, trying to figure out whether there is a capital partner for them. You’ve got strategic partners, presently, helping those small businesses make that decision. You know what, what are your frontline folks saying to small businesses to give them some of the insights that David and Phil just shared?

Denada Ramnishta, Lendio: I have to say, from all of our frontline folks, they have to a great extent turned in into really good listeners. Not that they weren’t before, but a completely different level now almost, you know, borderline psychologist, quote, unquote. The advice that I would say from a Lendio perspective, and again, not being a lender, but a facilitator, to a business owner would be, have a story to tell. If in the past, lenders didn’t necessarily listen to the story and simply look at the data, moving forward, at least in the interim, the story will matter. So a business’ ability to show flexibility around pivoting to create revenue.

This idea that you were a restaurant, but then you continue your delivery business or your retail store and you pivot to having an e-commerce presence. These are important stories that lenders do care about today, and they will, in the short horizon. So my advice would be, have a story to tell around how you navigated through this process. If before it didn’t matter because it was all about the data and the raw numbers, in the short term, it will matter, and lenders will look at it.

Amias Gerety, QED Investors: Arun, you’re committing capital. What did we miss in this conversation? What do people need to take away as they head into the Fall?

Arun Narayan, Kapitus: First of all, definitely keep yourself safe, but know that there are 12-15% businesses that are actually doing much better than pre-Covid. What have they done? What is it that they have done to adapt themselves? To David’s point, I think, focus on preserving your resources, making as much of fixed expenses as variable as possible. Push your local economy and local representatives to fight for you at the national level. I think the biggest is also business groups. If you are in a space that has online aggregators, like Lendio in lending, this is the perfect time to leverage that to get revenue and new business from there.