How to Spot Fake Bank Statements

As fraud continues to become more rampant, lenders need advanced technology to combat the new generation of sophisticated file tampering techniques used to falsify financial information, such as bank statements.

When loan applicants submit fake bank statements, lenders must be able to identify fraudulent documents to protect themselves and their bottom lines. As fraudsters become increasingly sophisticated, and fake bank statement creation services are more readily available, the risk grows for lenders. Lenders with the tools to accurately detect fake bank statements, such as bank statement verification software, can avoid approving fraudulent applications, minimizing business and regulatory risks.

Traditionally, lenders have manually reviewed and verified bank statements and other applicant documents. This process often requires multiple steps and reviewers, which can be time-consuming and inefficient. Not to mention, fraudulent and tampered documents can be undetectable by the human eye. Manual reviews can also expose lenders to potential errors, as even the most experienced underwriters are prone to human error.

However, today’s technology makes it possible to leverage AI-powered automation to identify fake bank statements, freeing lenders to spend their time on more strategic tasks.

How Can Lenders Spot Fake Bank Statements?

Fake bank statements can often resemble the real deal. Today’s fraudsters are improving their fraud techniques by using cutting-edge technology. For example, some cyber criminals use deep fakes, which blend machine learning and AI to fabricate photos, videos and audio more accurately. As more advanced fraud techniques like this become available and continue developing, it is becoming increasingly difficult for lenders to detect signs of file tampering.

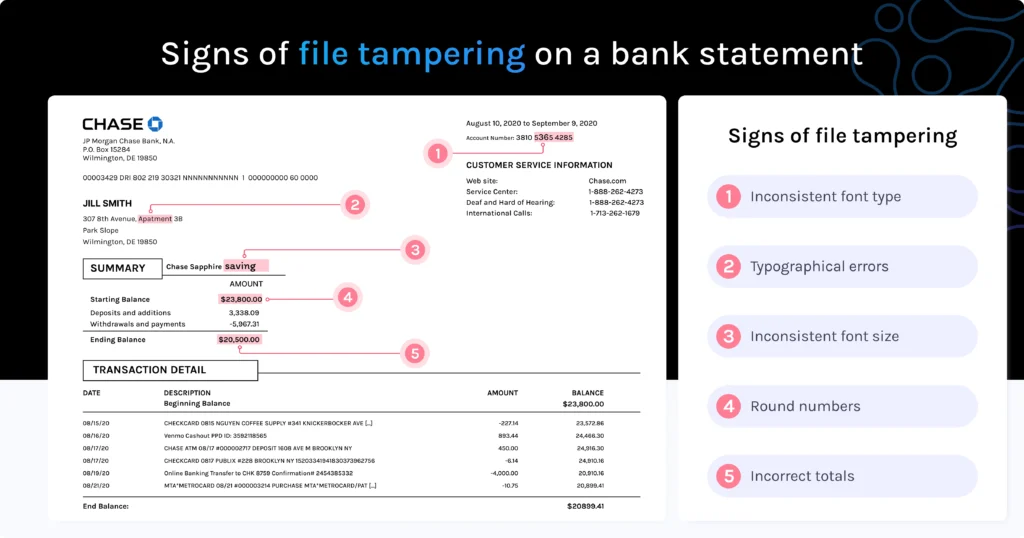

Signs of File Tampering on Bank Statements

Despite the increasing sophistication of fraudulent bank statements, there are a number of common signs of file tampering. If a lender sees one of the following, it is often an indicator of a fake bank statement:

- Inconsistent font type. A fake bank statement may use a font type that is slightly different from the font type used by the legitimate financial institution. Often, the difference is so subtle that only advanced document analysis can pick it up.

- Inconsistent font size. The font size on a fake bank statement may be slightly larger or smaller than the size used by legitimate financial institutions.

- Round numbers. Real bank statement figures rarely end in zeroes. If an unverified bank statement includes round figures, that’s a sign it might be fake.

- Typographical errors. Fake bank statements often include typos that would not appear on a bonafide document.

- Incorrect totals. Check the math on an unverified bank statement. The math may be inaccurate if it’s fake. For example, the figures for each listed deposit should add up to the figure listed for total deposits.

Although the human eye can detect some fraud, manual detection can simply not be reliable as the first line of defense against fake bank statements. That’s because not only are humans prone to error, but fraud is getting more sophisticated in ways that are undetectable by the human eye. As a result, automated and advanced AI solutions like bank statement verification software can be the best options for spotting a fake bank statement both accurately and efficiently.

Book your demo

See how to spot fake bank statements with Ocrolus

How Do Lenders Verify Bank Statements?

For many loans, lenders must verify a large volume of bank statements, sometimes up to 24 months’ worth of statements. Some lenders call the banks to verify account names, numbers, and deposit amounts. However, manual verification can slow down the underwriting process considerably.

Savvy lenders verify bank statements by using advanced automation solutions. Automated solutions such as bank statement verification software make it easy to accelerate the verification process and keep the underwriting process efficient. The right software solution can eliminate the need for staffers to make phone calls and instead uses machine learning to compare each bank statement to thousands of other verified statements, instantly flagging any areas that deviate from the standard or have been tampered with.

For example, Ocrolus offers Detect, an advanced fraud detection solution that evaluates a document’s origin and inspects it for signs of tampering after creation. Detect provides detailed signals that can outline exactly what has been changed in the document, allowing lenders to make more informed decisions.

When lenders use automation to spot a fake bank statement, they can benefit by:

- Spotting fraud quicker: Automated solutions can eliminate the need for manual verification of bank statements.

- Eliminating human error: AI can detect fraud the human eye may not catch.

- Detecting more fraud: Ocrolus Detect can alert lenders to 4X more fraud than other automated solutions.

Spot Fake Bank Statements at Scale with Ocrolus

As fraudulent activity becomes more widespread and more sophisticated, lenders must be aggressive in spotting fake bank statements to ensure the accuracy of their lending decisions. Highly sophisticated fraudsters create fake bank statements that can escape the scrutiny of human verifiers. Additionally, it can take many staffers and many hours for humans to manually verify all the documents needed to process a large number of loans.

With Ocrolus Detect, lenders can rest assured that their automated fraud detection solution will help flag suspicious bank statements, which can then be queued for further review by human staffers. Ocrolus ensures that documents can be processed quickly and at scale, while detecting suspicious bank statements efficiently and effectively. Lenders can process and verify bank statements and other documents in minutes with Ocrolus, speeding up their lending process by relying on advanced AI.

Connect with one of our experts to find out how Ocrolus can help you spot fake bank statements faster and more accurately with automation. Book your demo today.