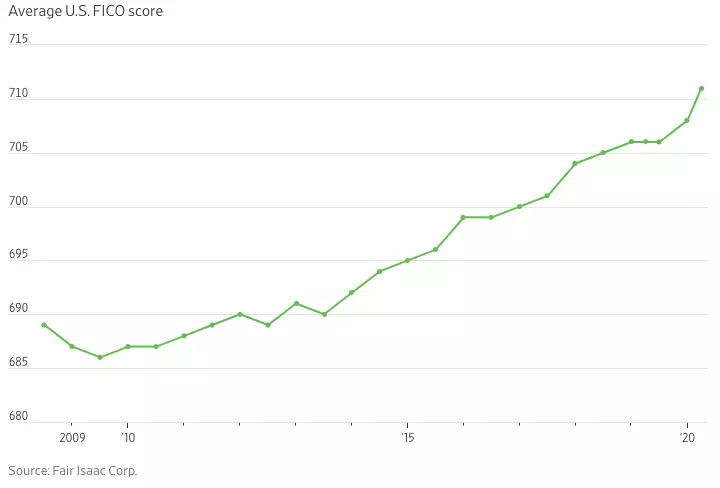

The average American’s FICO score rose to 710 in 2020. Here’s what FICO scores aren’t telling you

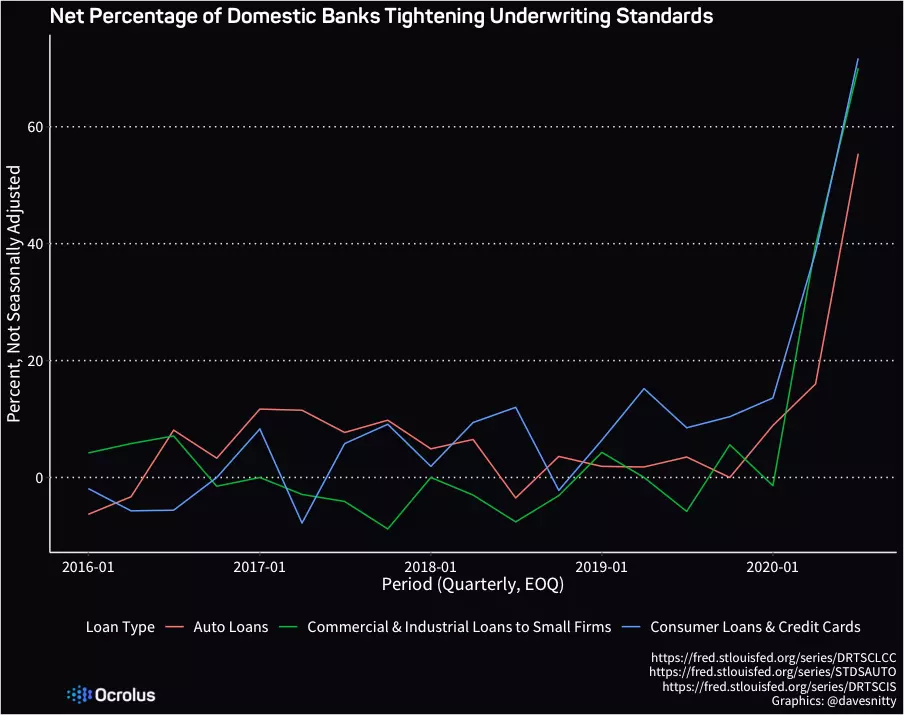

The average FICO score of an American consumer rose to 710 in 2020, an all-time high. At first glance, this number defies intuition. Are consumers better qualified than ever to take on additional debt? If so, why did 71.7% of banks tighten their underwriting standards in the 3rd quarter? If borrowers are truly low risk, one would expect to see low unemployment, robust economic growth, and high consumer confidence. Since none of those things are present, there’s something FICO isn’t telling us. As with so many aspects of life, 2020 is different. There are other dynamics at play, and they are changing the way people borrow and the way lenders underwrite them.

FICO is a statistical model that intends to predict a borrower’s likelihood of defaulting on a new loan. It is calculated using information that lenders report to credit bureaus on the borrower’s outstanding credit, repayment history, delinquency, and inquiries. In a period of high unemployment and negative GDP growth, delinquencies tend to rise, and FICO scores (after some lag) begin to fall. This was the case in 2009. There are two principal reasons why we don’t see the same score decrease today. First, massive government stimulus and unemployment benefits helped consumers pay their bills, even if they suffered decreased income due to the pandemic. Next, the CARES Act, which provided COVID-related aid and relief, restricted bank lenders’ ability to report deferral, forbearance, or loan modification to credit bureaus. In short, many consumers who wouldn’t normally be able to pay are temporarily buoyed by the stimulus, and for the consumers who have deferred or decreased payments, that fact is not reflected in their FICO scores.

These recent circumstances add to the already-known blind spots in FICO. For example, FICO does not take income or employment into account, and it does not generally include information on non-credit payments, such as rent or utilities (apart from some more recent versions of FICO that are less frequently used by lenders). Furthermore, FICO can only be calculated on those with sufficient credit history. The CFPB estimates that at least 26 million adults in America are ‘credit invisible’. This includes a number of potentially credit-worthy adults in the burgeoning gig economy. Credit data and FICO scores, when rich and accurate, provide a valuable resource for lenders in making underwriting decisions. Today, however, it has become more clear than ever that credit data alone is insufficient. Forward-thinking bank lenders are rapidly adopting new technologies and information sources to make high-stakes decisions with their capital.

In Q3 2020, 71.7% of domestic banks reported tighter consumer underwriting standards. The trend is similar for auto loans and business loans. With less faith in credit scores and uncertainty around the likelihood of additional stimulus or the pace of economic recovery, banks are deciding to take less risk.

Adopting Cash Flow Underwriting

Lenders of all kinds are also rapidly adopting what has come to be known as “cash flow underwriting”. Using bank transactions, payroll data, and other information, lenders aim to calculate the income, expenses, and cash ‘cushion’ of borrowers in order to determine their financial resilience, debt capacity, and ability to pay. At Ocrolus over the past 6 months, we have seen cash flow underwriting go from a novel curiosity to a must-have, with fintech lenders and banks rushing to adopt it.

Given the high levels of volatility and uncertainty, lenders are spending more time on fraud prevention, verification of income and employment, and cross-source validation of data. We’ve seen fraud rates increase sharply on certain types of data, and synthetic identity fraud is a significant and growing concern. Self-reported income no longer can be relied upon in many cases, and lenders are seeking proof of employment to gain a more up-to-date and accurate picture of a borrower’s financial situation. Overall, lenders are seeking more data, from a greater number of sources, and across longer time periods (e.g., 6 months of bank statements instead of 3). With the multiplicity of sources and the need for consistency, cross-source validation of data has also become a must-have.

When it comes to measuring the economy, we have an indicator problem. Politicians, journalists, investors, and business people are always on the lookout for a single metric that they can monitor to trace the direction of our collective economic fortunes. Our world, however, contains complexity that can never be conveyed by a single number. Moreover, in volatile times, the correlation between any given metric and the real-world circumstances it attempts to represent can change rapidly. Just as the movement of the 30 stocks making up the Dow Jones Industrial Average does not fully represent the health of our economy, FICO scores do not adequately portray the health of the American consumer. While traditional consumer credit data remains a useful source of information, smart lenders will need to rapidly adopt the data sources, technologies, and flexibility required to drive growth with confidence.

Learn how Ocrolus solutions can help lenders adapt to the new economy and regain confidence in lending practices.