This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Insights under the surface: How forensic analytics helps SMB funders better manage risk

Cash flow data provides a wealth of information for small business funders to improve their decision-making processes. By uncovering patterns in revenue, expenses, seasonality, recurring transactions and more, cash-flow-based risk models can provide a more complete picture of financial health than traditional credit bureau data alone.

Armed with these insights, funders can more accurately predict the risk of default while expanding access to capital for qualified borrowers who may have declined due to poor credit.

Ocrolus recently added three new signals for cash flow analysis that give small business funders an even deeper understanding of their customers, using forensic analysis to uncover a new level of detail and empower them to make fully informed underwriting decisions.

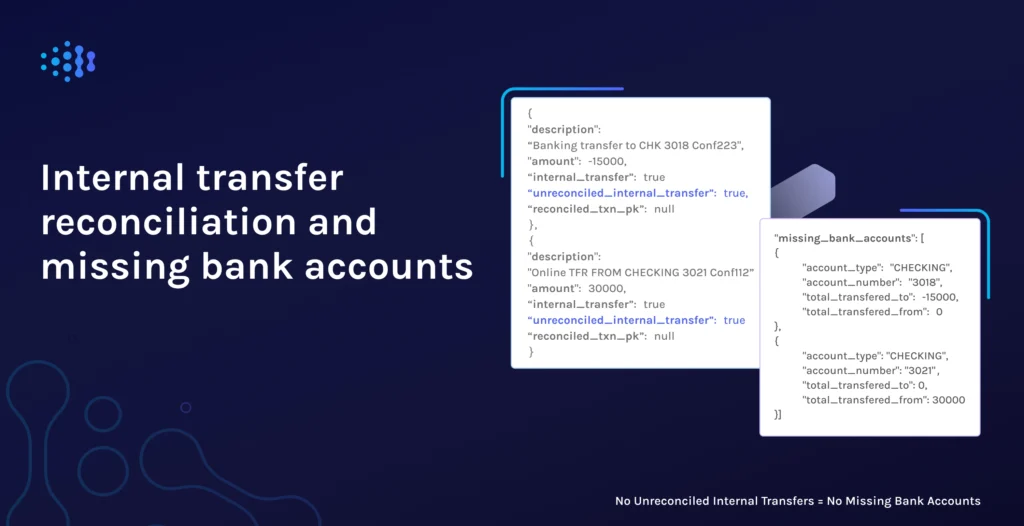

Unreconciled internal transfers

Identifying missing information in applications is critical for funders to accurately identify risk. Within submitted bank statements, Ocrolus helps small business funders determine whether internal transfer transactions are reconciled or unreconciled within provided documents. An unreconciled transaction may indicate that an application lacks banking information for applicants’ other accounts.

With a new transaction tag for unreconciled transactions, funders can easily identify areas where borrowers may have provided incomplete details on their finances and where further investigation or additional documentation may be required.

For cases where Ocrolus can identify both bank accounts listed in the internal transfer within application documents, funders receive both a confirmation tag and additional information on the corresponding account for added confidence.

Identifying missing bank accounts

Where unreconciled internal transfers exist, funders have a clear sign that a borrower may not have submitted enough information to understand their financial health. However, even with unreconciled transfers, it can be difficult for funders to pinpoint the total impact of missing information and to identify the accounts that were not submitted.

Ocrolus goes one step further to help funders not just understand if account information is missing but identify the amounts transferred to and from that account. With this new feature, Ocrolus provides funders with the information they need to gather additional information, including the account number, account type and the total amounts transferred in and out of the missing account.

This information helps funders work with borrowers to ensure they have all information needed to understand a business’ finances and ability to repay fully.

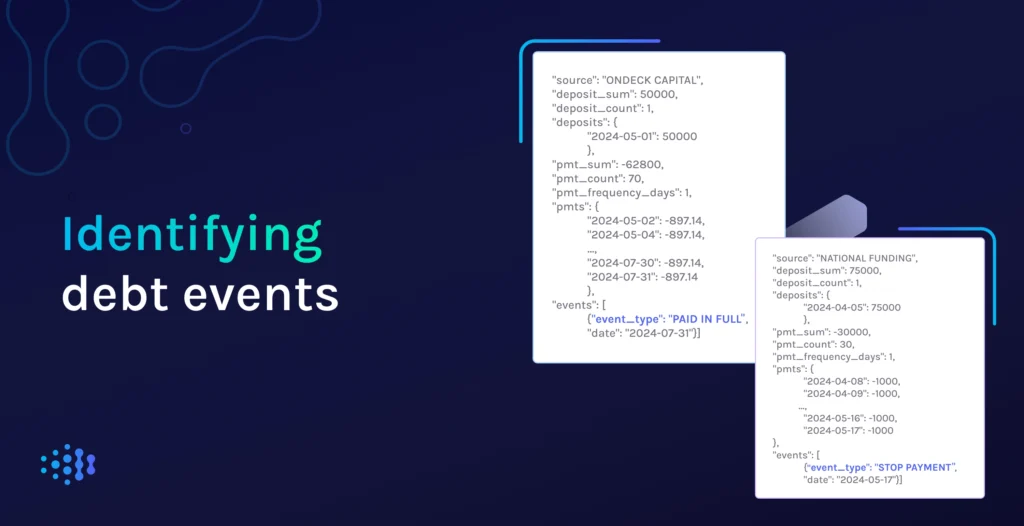

A more complete understanding of debt obligations

Beyond these features for internal transfers, Ocrolus has also introduced an enhanced payment pattern analysis capability to identify changes in borrowers’ payment behavior related to existing debt obligations and determine missed payments or renegotiations.

Understanding when loan obligations have been paid in full or when payment amounts or frequency changes occur gives funders added context to evaluate a borrower’s ability to repay. With this feature, funders can quickly see if borrowers have changed payment frequency, stopped payments altogether, or paid existing debt in full.

Payment pattern analysis also provides a more comprehensive view of fintech loans and fintech merchant cash advances. By classifying non-descript wire transfers as potential debt inflows, Ocrolus can flag these transfers as fintech loans or MCA disbursements to understand borrowers’ total loan obligations better.

Small business funders need a wide range of information to make fully informed underwriting decisions. With Ocrolus’ growing cash flow analytics capabilities, funders gain a more complete view of financial dynamics, helping them manage risk while quickly and confidently writing more loans.

To learn more about Ocrolus’ latest forensic analytics capabilities and how they can help you gain a complete view of small businesses’ financial health, watch our recent Product Pulse live session here or book a demo today.

Key takeaways:

- Ocrolus has added three forensic cash flow analytics capabilities to help small business funders better understand borrowers’ financial health and ability to repay.

- Identifying unreconciled internal transfers and the associated bank accounts can help funders identify missing information and related bank accounts.

- Payment pattern analysis helps funders classify debt payments and identify when borrowers have missed payments or renegotiated, giving them a better understanding of existing debt obligations.