This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Why cash flow data belongs at the top of your small business underwriting funnel

Using bank-derived credit attributes to approve more applicants, decrease risk, and minimize cost in the SMB underwriting process

Small businesses are the lifeblood of the U.S. economy, providing 56 million jobs, generating 43.5% of our GDP, and meaningfully contributing to economic growth. Nearly every business relies on access to capital, enabling it to expand operations, finance inventory, manage volatile cash flows, and make investments in the future. The efficiency, effectiveness, and scale at which lenders can provide small businesses access to capital directly affects economic well-being. Ocrolus is proud to work with over 175 SMB lenders to enable them with advanced technology and analytics.

The importance of cash flow data

Our development of highly predictive analytics, our progress in achieving document automation with AI, and our work with the country’s most sophisticated business lenders have led us to conclude that the evaluation of cash flow data belongs at the top of the small business underwriting process.

Assessing the risk of a small business applying for credit is notoriously difficult, at least an order of magnitude greater than doing the same for a consumer applicant. Each small business is unique. The firms often operate in volatile and seasonal markets, and no single data source completely encapsulates the complete financial picture of small businesses. As such, lenders generally construct an underwriting funnel composed of multiple data sources, various steps for verification, and a reasonably nuanced logic for approve/decline decisioning and for calibrating the terms of an offer. As a lender endeavors to construct the process and policy that will best enable it to maximize profitable origination while avoiding unnecessary credit and fraud losses, it must also control costs and deliver a high-quality and fast customer experience. It could be optimal, ad absurdum, for a lender to request hundreds of pieces of documentation and other data sources to make the absolute best quality decision. Still, such a process would surely bankrupt the lender while also chasing away all but the most desperate applicants.

Constructing the underwriting funnel

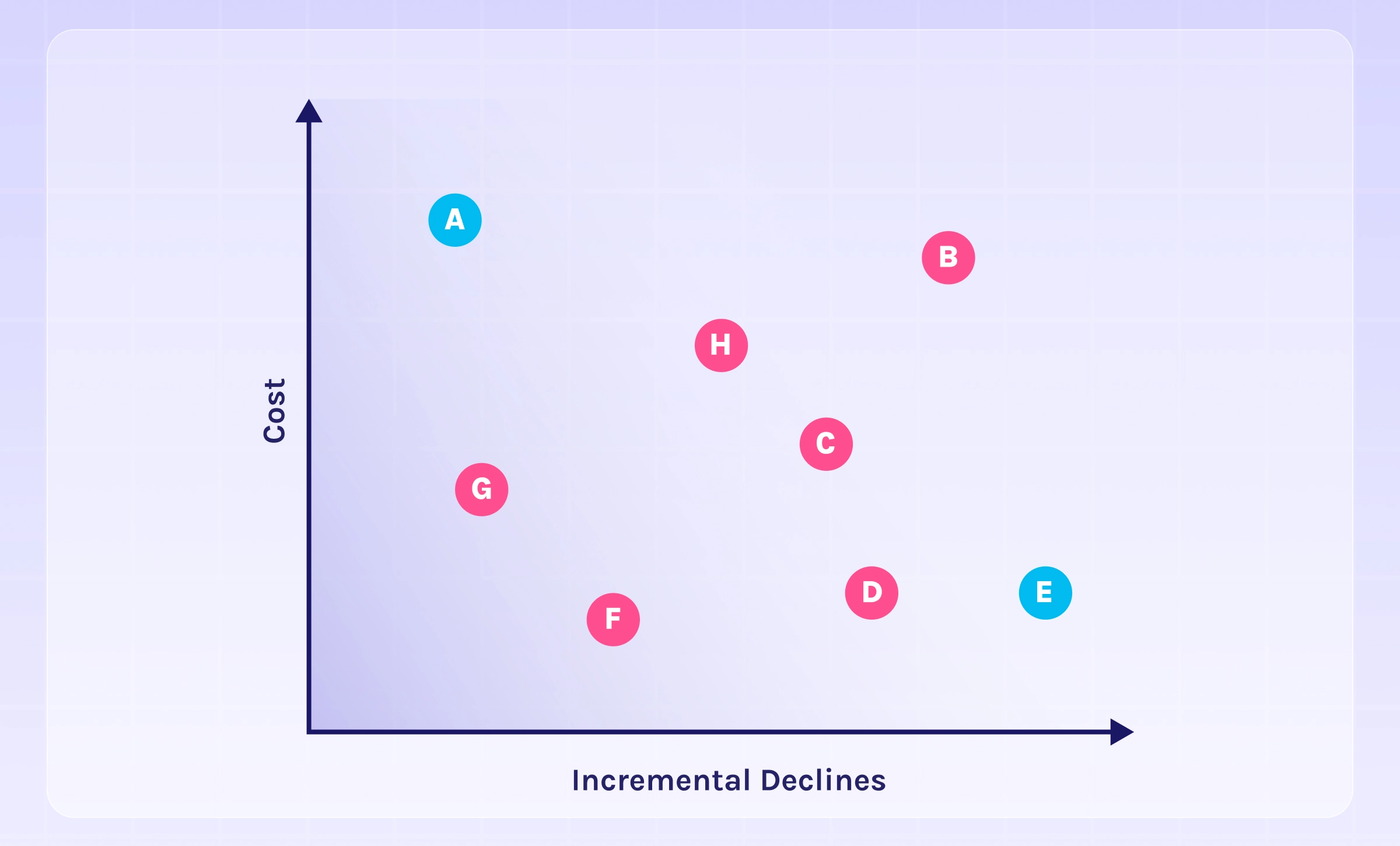

Knowing the background of this complex, multi-factor optimization problem, lenders face the question of which data sources to use in underwriting and in what order. Both components of this question are important. Each possible data source can be considered regarding two factors: its ability to incrementally decline undesired applicants and its cost. Presented visually, lenders would want to prioritize data sources closer to the lower-right corner of the matrix below.

- https://www.pewresearch.org/short-reads/2024/04/22/a-look-at-small-businesses-in-the-us/

- https://www.uschamber.com/small-business/state-of-small-business-now

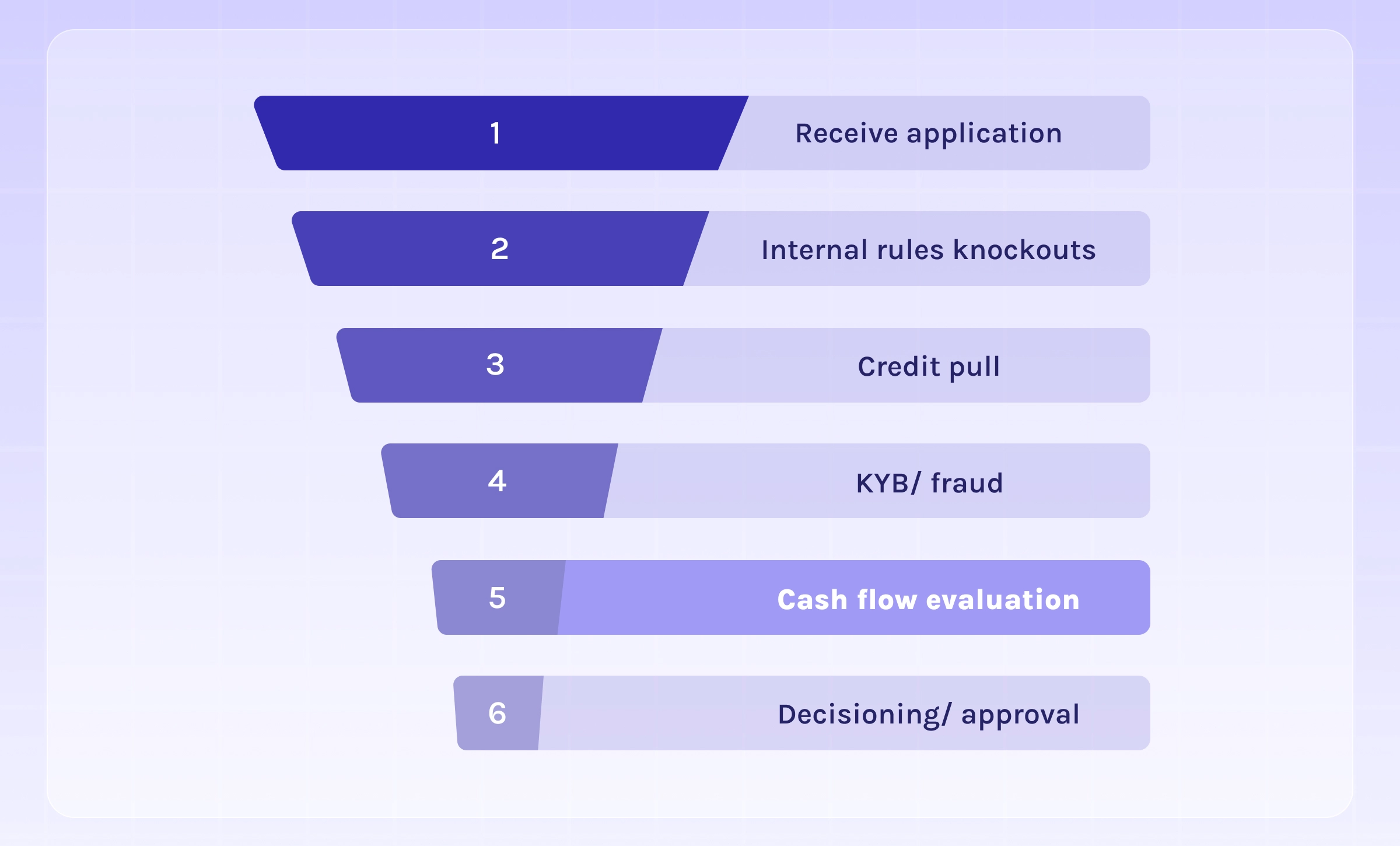

As much as it would be analytically preferable to get all the valuable data sources for each applicant and view the business holistically, lenders generally prefer this funnel approach to save on the downstream data costs for applicants who fail upstream checks. While every lender is different, a typical pattern we have seen frequently among small business lending clients follows the graphic below.

In the above process, lenders iteratively knock out applicants who fail criteria based on each successive data source, with those passing each gate ultimately receiving credit offers. Even though cash flow data is valuable in understanding business viability, many lenders have only assessed this information if an applicant has made it through the other gates. This is due to the cost of obtaining and processing bank data and the difficulty in extracting its useful signals.

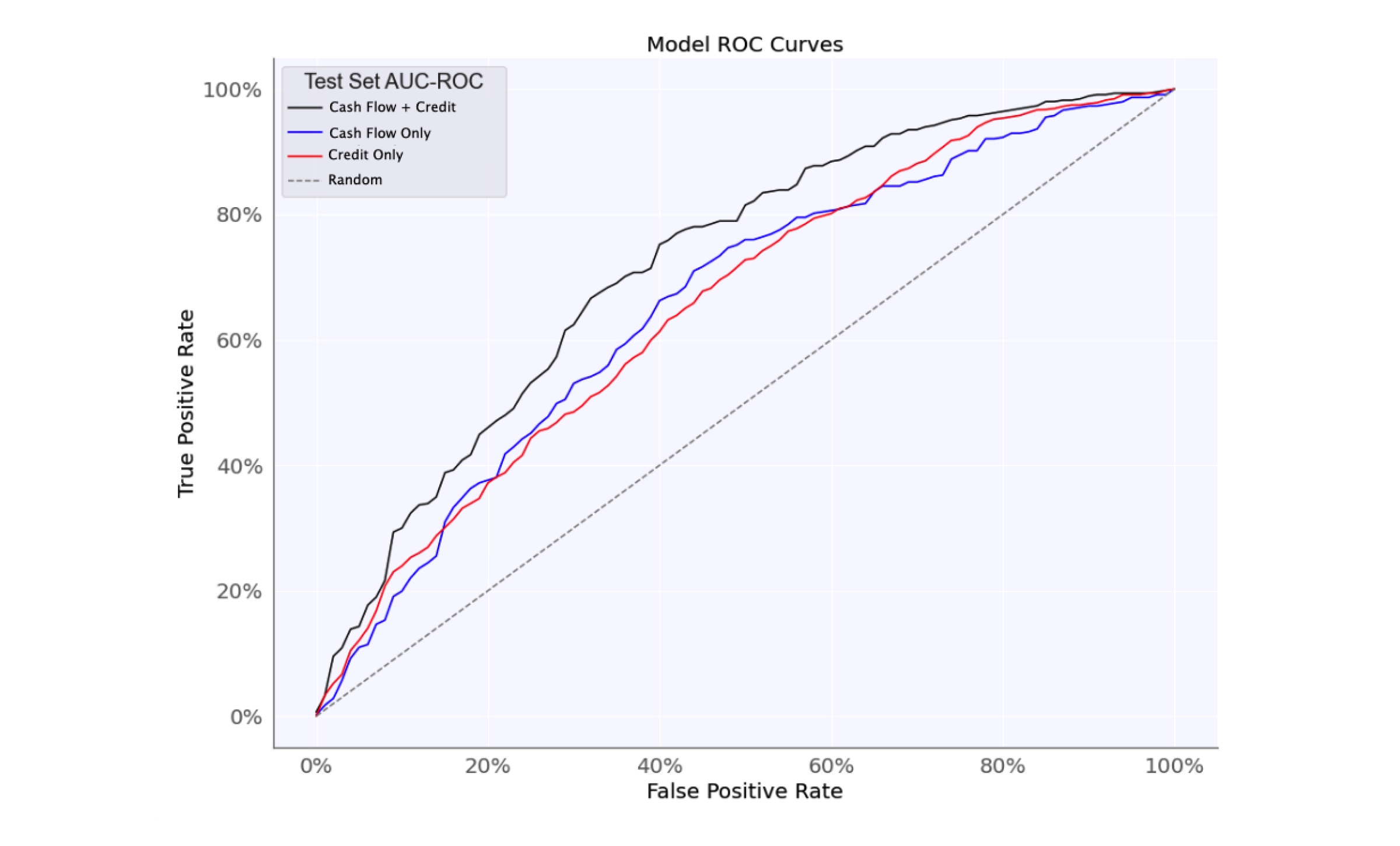

Over the past year, Ocrolus’ small business lending product roadmap has been focused on solving these 2 problems. First, our massive repository of verified bank statement data has enabled us to build incredibly accurate AI for document automation, meaning that we’ve been able to speed up processing and drive down costs with 100% coverage of even the messiest and lowest-quality scans. Next, our latest cash flow analytics suite helps lenders easily understand small businesses’ financial health, including their revenue, expenses, debt capacity, seasonality, and more. Lenders use Ocrolus cash flow attributes to build finely-tuned risk prediction models that far surpass the utility of credit data alone when combined with credit data.

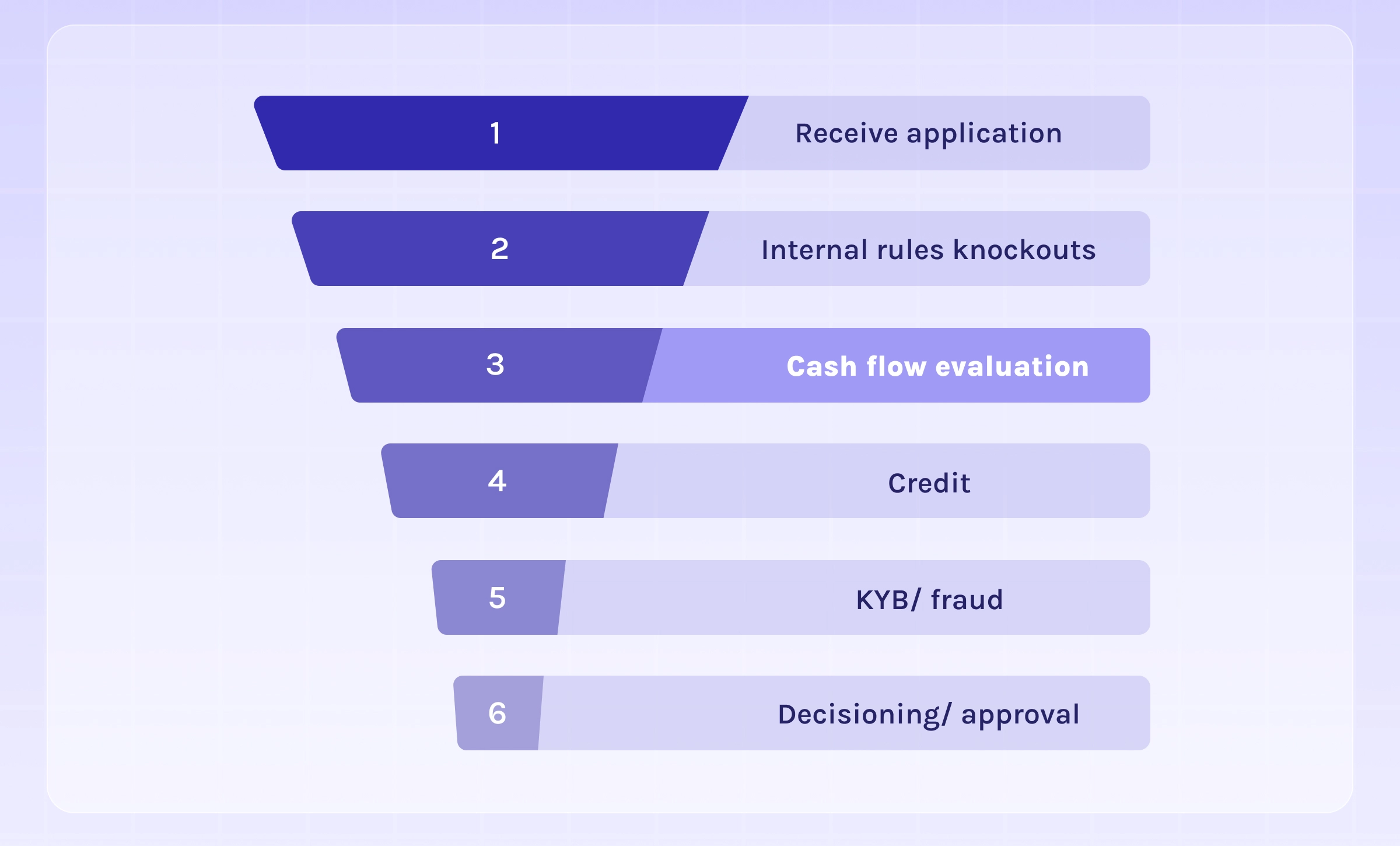

With more predictive signals and a more favorable cost structure, we’ve seen it become advantageous for many small business lenders to move cash flow analysis to the top of their evaluation processes, even before pulling credit bureau data. If getting cash flow data is sufficiently predictive and cost-efficient, it makes sense to do it first and save on bureau costs for those who wouldn’t pass. This leads to a funnel like the one visualized below:

To further illustrate the impact of a cash-flow-at-the-top funnel, we can do some basic math on the cost of processing an application under various assumptions. Let’s take a lender processing 10,000 applications per month and spending $3 on each credit bureau pull. Let’s also say that the lender knocks out 25% of applicants based on that bureau data, then analyzes bank cash flow data on the remaining 75%, knocking out an additional 35% of that population using the bank data. For simplicity, we’ll ignore other data sources, costs, and operational details in the underwriting flow. Suppose this lender switches to analyzing bank-derived cash flow data ahead of credit. In that case, it will benefit from examining a more predictive data source earlier in the process and from a reduction in credit bureau spending. (footnote: the Ocrolus team is happy to walk through and customize many of the more intricate, behind-the-scenes assumptions in a live conversation.

Inputs

Results

Benefits of a cash-flow-first approach

In the above example, the cost per decline was reduced by 23%, equating to an annualized savings of $138k for a lender getting 10,000 applications per month with an approval rate of 38%. In addition to the material decrease in operational expenses, lenders using cash flow data as the primary input into small business underwriting experience benefits in the following areas:

- Decreased credit losses: Combining detailed and well-tuned cash flow attributes with bureau data yields a winning combination for precisely modeling a small business’s risk and capacity to service new debt.

- Increased originations: Lenders who save on OpEx and who can more precisely separate desirable from undesirable applicants have the option to redirect capital towards approving more good customers.

- Customer experience: The speed-to-decision and higher approval rates made possible by cash-flow-first business underwriting lead to a more favorable borrower experience and ultimately, greater access to credit for small businesses.

Implementing this process

How can small business lenders assess the viability of a cash-flow-first underwriting process and position themselves to take advantage of its benefits?

- First, it’s important to catalog each step in your existing underwriting funnel to understand its cost, time, and knock-out rate. When considering the cost, remember to include both the cost of data and any manual processing required by underwriters or other staff.

- Next, a “retro” analysis will be conducted to generate cash flow attributes for historical applicant bank data and model the attributes’ ability to predict loan outcomes. Ocrolus frequently helps clients perform this exercise.

- This may lead you to adjust decision criteria and policy cutoffs.

- With this new information, you can construct an ‘alternate’ funnel that puts cash flow data closer to the top.

- Then, it is possible to step iteratively through both funnels to understand their impact on total cost, approval rates, and risk.

The ability to provide capital to small businesses most efficiently and cost-effectively benefits these firms and also the economy at large. If you are interested in exploring a cash-flow-first approach to small business lending, the team at Ocrolus would be happy to help!