This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Underlying Trends in Consumer Lending for The Auto Loan Market

See an updated version of this post for 2022 here.

Cars and credit are two of my favorite topics. Last week, I spoke to Ed Garsten at Forbes to share thoughts on tightening underwriting standards in auto finance, along with the deeper trends driving evolution in consumer credit more broadly. Amidst higher delinquency rates, uncertainty around post-pandemic consumer financial health, and the growing insufficiency of traditional underwriting methods, auto lenders have tightened their criteria for new borrowers, and new origination has decreased. The implications of this trend are not limited to the automotive industry. All forward-thinking consumer lenders will need to revamp their underwriting practices, with an emphasis on broader data sources, real-time information, and more segmented and personalized assessment strategies.

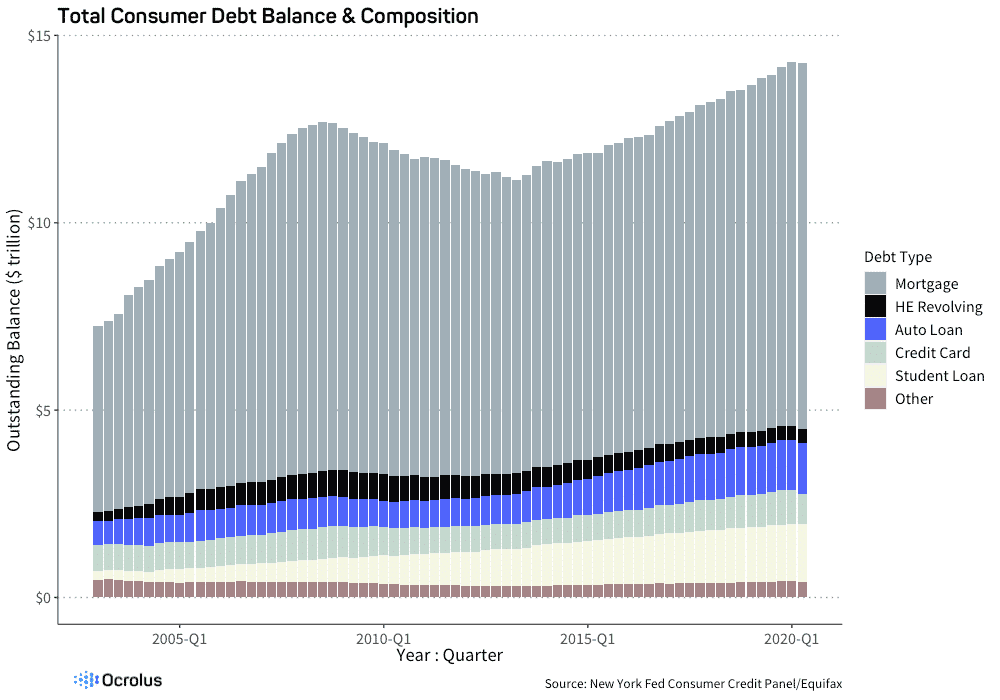

Before we dive into the auto loan market data, let’s take a look at U.S. consumer debt in general. As we can see below, total debt has increased in recent years, extending substantially beyond its earlier peak in 2008. Auto loans have increased in size and share.

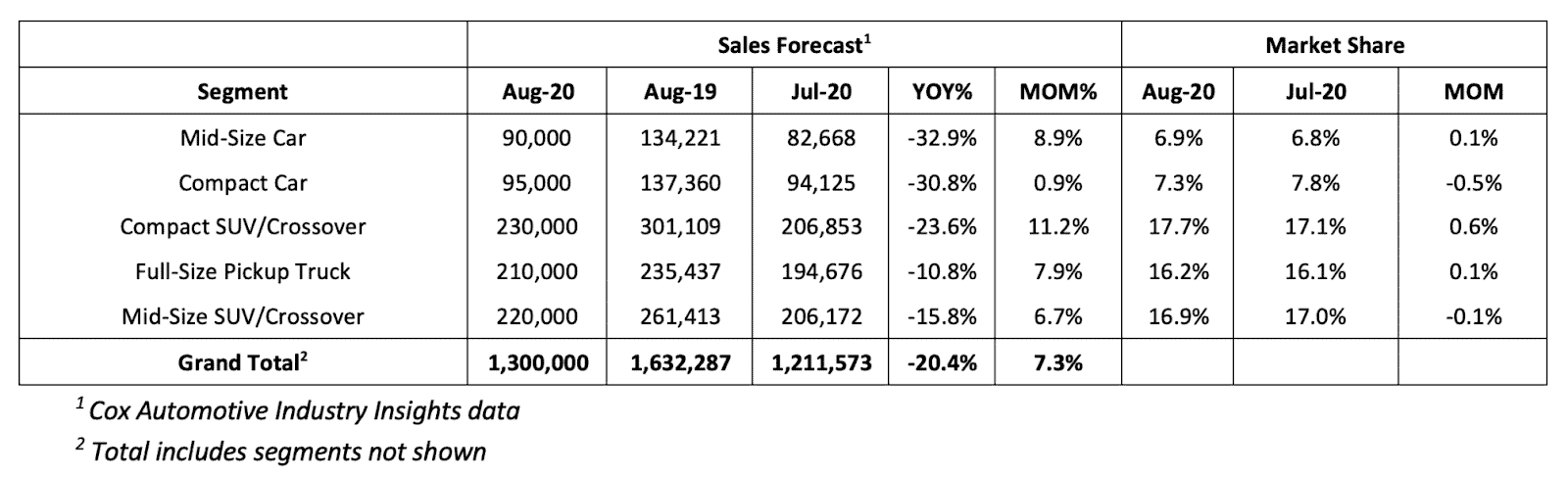

U.S. auto sales were down 20% in August compared to the same period in 2019. As we can see in the table below from Cox Automotive, this trend exists among all vehicle segments.

Some of this decrease in purchase volume is likely due to fewer consumers’ ability to qualify for a loan. Indeed, overall loan volume was down 10% between Q1 and Q2 2020, whereas volumes typically increased substantially between the first and second quarter of the year (i.e. up 11% in 2019 and up 15% in 2018).

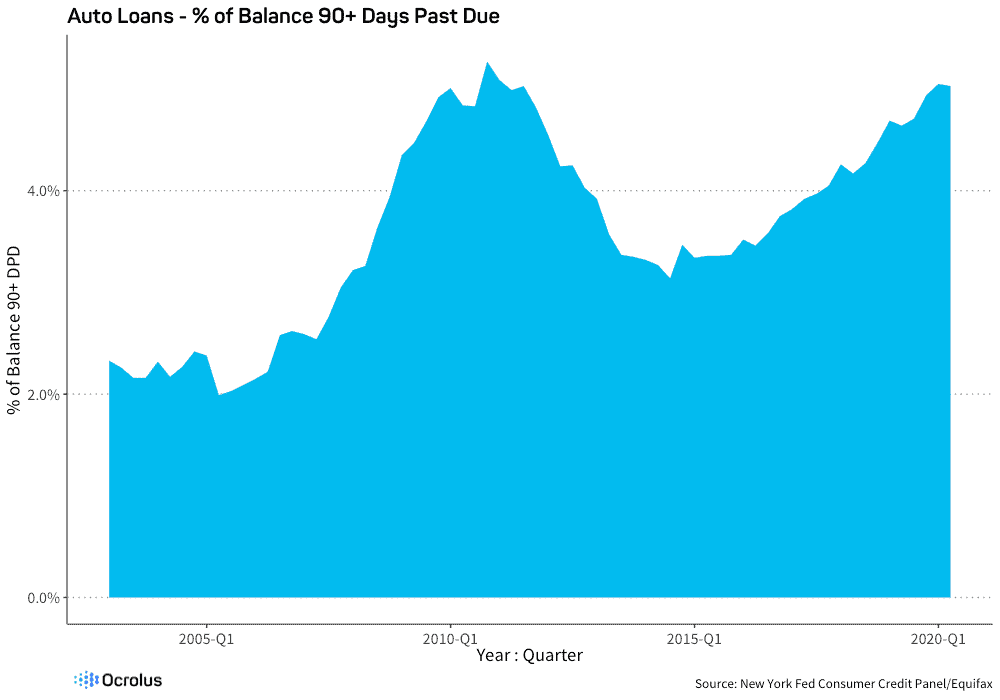

Delinquency rates on existing auto loan balances are now close to their Great Recession highs. This is a trend that predates COVID-19, as subprime auto lending had increased substantially in the past several years given the general availability of funding in the capital markets and the positive economic environment. With the massive increase in unemployment due to the pandemic, we are likely to see these numbers go up in the coming quarters, particularly if government benefits expire.

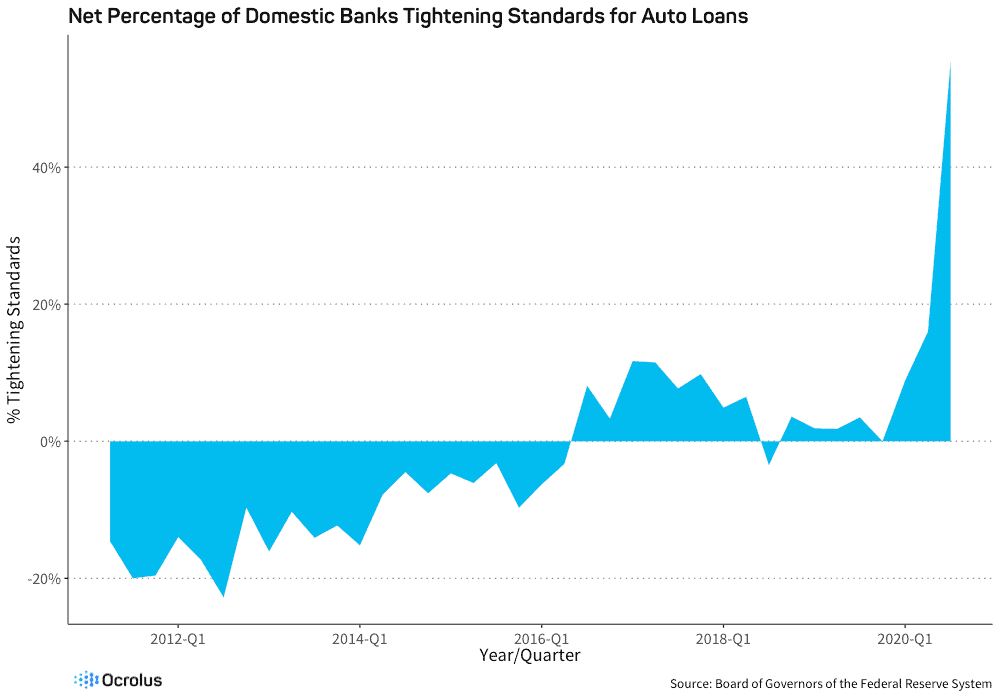

Given the observed levels of delinquency, the economic headwinds affecting consumers, and the general uncertainty around consumer financial health, banks have sharply tightened their underwriting criteria for auto loans. As we can see below, the net rate of banks reporting more stringent requirements jumped to 55% in Q3.

The data from the auto sector provide a good example of the trends affecting all of consumer lending, from mortgage, to personal loans, to student loans. The sharp and unprecedented effects of the COVID-19 pandemic and its ensuing economic downturn have revealed the insufficiency of traditional underwriting methods. Given the high levels of unemployment and underemployment, the past payment behavior that appears on a credit bureau may not tell the full story of a customer’s ability to pay today. Furthermore, the CARES Act (i.e. Coronavirus aid package) prohibits certain types of adverse credit reporting during the COVID-19 crisis. Therefore, not all potentially negative information will show up on a credit report, adding to lenders’ blind spots. In a time of great volatility, forward-thinking lenders are utilizing data from sources such as bank statements, paystubs, and more in order to construct a fuller and more real-time picture of a borrower’s ability to pay. As fewer Americans earn their incomes from traditional sources (i.e. the proverbial ‘9-5 job’) and shift to freelance work, the ‘gig economy’, and other types of labor, lenders will need to ingest, synthesize, and analyze multiple sources of data to understand cash flow and a borrower’s capacity to service debt. This generational shift is likely to continue well beyond the tumult of 2020.

Over the coming months, it will be interesting to monitor these trends in consumer lending. For the financial institutions that serve American consumers, it will be critical to adapt to this new environment by adopting the data sources, technologies, and automation-driven personalization needed to drive growth with confidence.