Live session recap: Managing the change to AI-driven mortgage underwriting

The mortgage industry is preparing for a potential loan origination and refinancing rebound on the heels of the Federal Reserve’s rate cuts last month. In preparation for this expected volume increase, lenders should consider what effective scalability looks like – and how they can position themselves to capitalize on higher origination and refinance volumes.

Mortgage demand naturally fluctuates with economic cycles, and the best, forward-thinking lenders are turning to AI-driven automation to gain a competitive edge amid this volume increase.

In a recent live session, Ocrolus Director of Product (Mortgage) Rebecca Seward and Senior Sales Engineer David Gipson discussed how lenders can leverage AI and advanced technology, rather than traditional hiring and firing methods, to scale with the market more efficiently.

State of the mortgage market: Preparing for a rebound

The mortgage market is cyclical in nature, ebbing and flowing alongside macroeconomic trends. The prolonged period of stagnation that the industry experienced following COVID-era rates points to a potential rebound.

At the same time, mortgage loan origination costs have risen 35% over the past three years, according to industry reports, putting pressure on lending teams to improve operational efficiency and reduce the cost of doing business.

Traditionally, the mortgage industry has responded to increasing loan volume by going on a hiring spree, as more underwriters are needed to manually process documents. This approach often creates inefficiencies and volatility within organizations, as decreases in loan volume tend to result in layoffs and turnover.

Lenders need to avoid past mistakes by leveraging advanced technology such as AI-powered document processing – rather than hiring and firing – to build scalability into their processes.

Transitioning to AI-driven underwriting

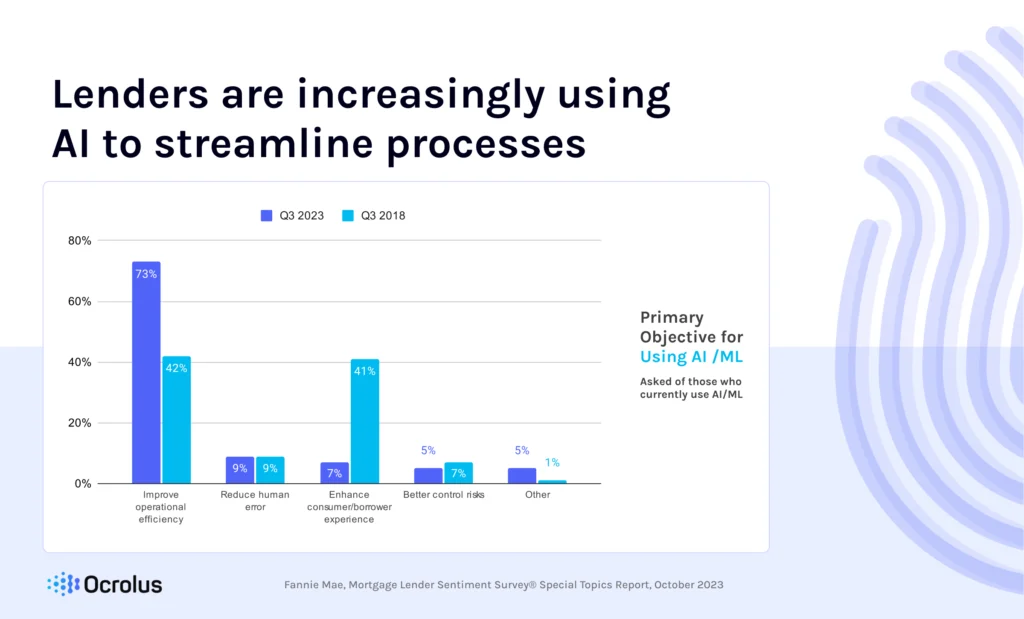

Lenders increasingly turn to AI-powered solutions, such as Ocrolus, to streamline processes and respond to market fluctuations. The technology allows lenders to automate document handling, improve underwriting efficiency, simplify income calculations and reduce operational costs.

As is the case with most major organizational shifts, some team members may have some reservations about adopting AI. But, once they see the time it can save and the benefits to their own work, the value becomes clear.

To ensure the seamless and successful integration of AI technology, financial organizations should have a dedicated plan to test out and ultimately integrate AI-powered solutions within their teams. Organizations should set business goals and define KPIs for AI, roll out the new tech with a pilot group, share the results and leverage their influence to encourage adoption.

Financial service providers can further empower their teams to succeed with AI technologies with Ocrolus’ free AI Empowered Underwriter Certification. This program helps underwriters understand how AI can automate repetitive tasks and gives them the knowledge they need to unlock the game-changing potential of AI in their work.

Building a scalable mortgage underwriting process

Hiring and firing to meet changing demand is no longer a sufficient strategy in the modern lending ecosystem. With AI and automation, scalability is embedded directly in the mortgage workflow, positioning lenders to respond to market fluctuations without needing to adjust their staff.

Before lenders can reap the benefits of AI-powered underwriting, some important considerations must be made when adopting AI for the first time—including integration with existing systems, the skills and training needed for AI-assisted roles, and the KPIs to evaluate success.

Watch the full session here, and book a demo today to learn how AI can help your mortgage lending team manage the change to AI-driven underwriting and prepare to respond to market changes more efficiently.

Key takeaways

- AI-powered automation enables lenders to scale mortgage operations more efficiently, reducing reliance on traditional hiring and firing practices during market fluctuations.

- Adopting AI in underwriting enhances document processing, income calculations and operational efficiency, allowing teams to manage increased loan volume while lowering origination costs.

- Successful AI integration requires a structured approach, including setting KPIs, piloting the technology and leveraging training programs like Ocrolus’ AI Empowered Underwriter Certification to drive team adoption.