This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Loan Fraud Detection: How Lenders Can Identify Loan Fraud Faster and More Accurately

As technology and automation rise, so do the risks of fraud. Specifically, loan application fraud is getting more sophisticated, meaning lenders need to be aware of the common tricks and scams.

According to BusinessWire, “in the second quarter of 2022, an estimated 0.76% of all mortgage applications contained fraud, about 1 in 131 applicants.” For some, that percentage may seem negligible, but just one of those fraudsters having success could be hugely detrimental to your lending business.

As the lending industry adopts more automation, it’s essential to understand how that same technology can protect against loan application fraud.

What is Loan Fraud?

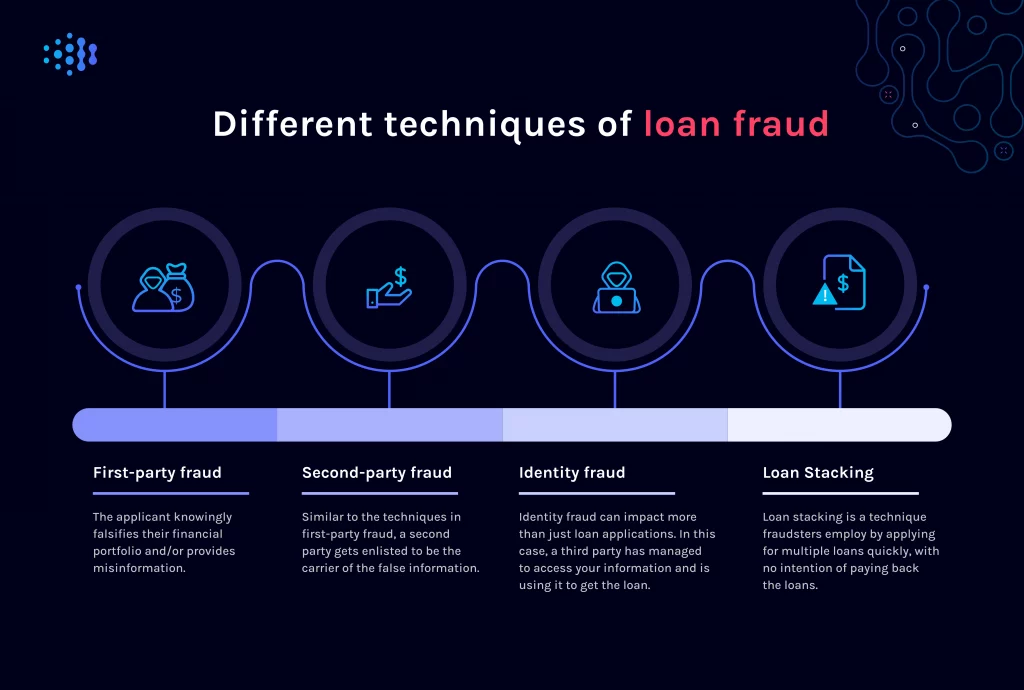

Loan fraud happens when a fraudster attempts a deceitful action designed to gain a financial advantage during the loan application process. This can be received broadly, because there are many advanced techniques used to execute fraudulent loan applications, including:

- First-party fraud

- Second-party fraud

- Third-party fraud

- Loan stacking

What are the different techniques of loan fraud?

As the saying goes, there’s more than one way to cook an egg, which definitely applies to loan fraud. As shown above, there are many ways that sophisticated fraudsters can attempt loan application fraud.

- First-party fraud

The applicant knowingly falsifies their financial portfolio, and/or provides misinformation.

- Second-party fraud

Similar to the techniques in first-party fraud, a second party gets enlisted to be the carrier of the false information.

- Third-party fraud

Identity fraud can impact more than just loan applications. In this case, a third party has managed to access your information and is using it to get the loan.

- Loan stacking

Loan stacking is a technique fraudsters employ by applying for multiple loans in a short timeframe, with no intention of paying back the loans.

How Ocrolus detects loan fraud

As an advanced loan fraud detection solution, we’ve seen and heard of a few sinister attempts at loan fraud ourselves. As the lending industry continues to seek automation and efficiency, it also must keep security and safety top of mind.

By partnering with Ocrolus, lenders can utilize Detect, our automated document fraud detection software. With Detect, not only can we identify and help to prevent fraud, but we can do it earlier in the process so that lenders’ valuable time is not wasted on a fraudulent loan application.

Ocrolus’ AI-powered document automation software has been programmed through more than 100 million pages of documents from thousands of leading lenders. Therefore, our algorithm is incredibly sophisticated and equipped to combat even the best fraudsters.

As a lender, you have a responsibility to yourself, your team, and your business to take loan fraud seriously and act quickly. As the lending industry becomes more competitive, requiring lenders to turn to automation to improve loan turnover, partnering with Ocrolus can ensure that:

- You can make quicker, more confident decisions about an applicant, leading to faster loan turnover.

- You will reduce your risk of loan fraud, and uncover up to 10x more file tampering with better accuracy.

- You minimize manual review.