This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

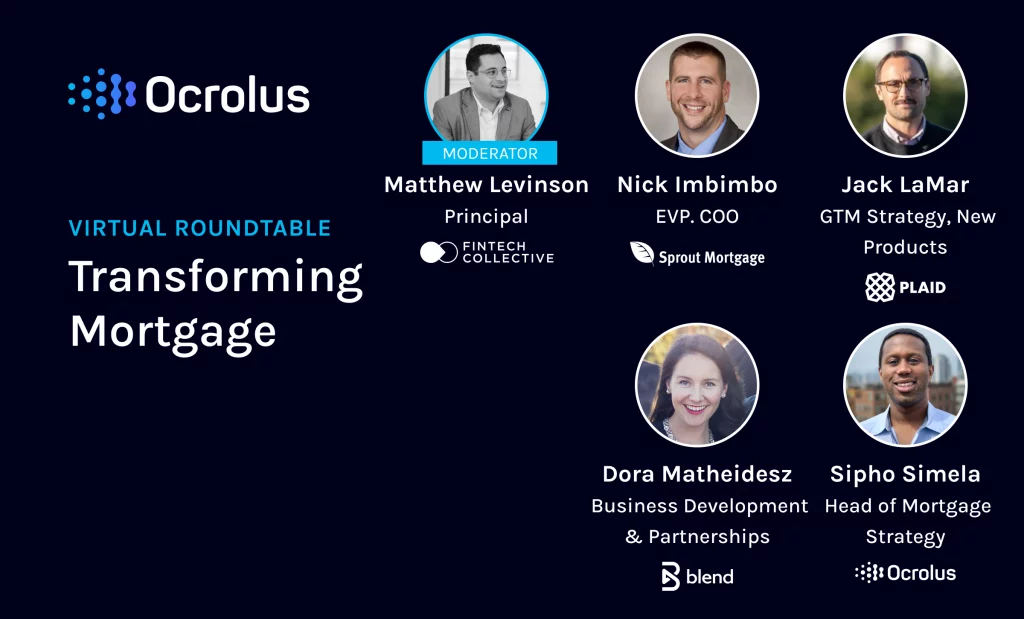

Virtual Roundtable: Transforming Mortgage

Explore the current and future state of the mortgage industry in the U.S. with lending experts from Plaid, Blend, Sprout Mortgage, Fintech Collective and Ocrolus.

WATCH THE COMPLETE DISCUSSION ON-DEMAND

Snippet of Virtual Roundtable Transcript

Matt Levinson, Fintech Collective:

Sipho, for those on the call who aren’t intimately familiar with the product. So, I sent 19 PDFs over email to my mortgage loan officer. What can you do with those documents? What pieces can you automate? Is it just taking data and turning it into ones and zeros, or what are the different components in terms of document classification, extraction, and that fuller value proposition that you guys can give to an originator?

Sipho Simela, Ocrolus:

Yeah, sure. Here at Ocrolus, we are a FinTech infrastructure platform. A lot of words, but very clear meaning. Where we fit in the overall flywheel of mortgages, we are responsible for collecting and digitizing documents. We don’t just start with grabbing a bunch of docs from a folder. We provide actual context and machine learning around our document catering process. So, those 19 PDFs that you mentioned, whether you upload those as one large PDF or split them out into 19 different uploads, Ocrolus has a machine learning-based approach that allows us to, first and foremost, classify those documents on behalf of your lender.

Sipho Simela, Ocrolus:

In this lender community that we’ve built out, there is something to be said about the contributed learning of these machine learning models. They’re able to quickly develop, quickly scale up, and ramp, whereby that packet of documents can be clearly and easily classified. What makes Ocrolus somewhat unique in the market is what we include called our human in the loop. So think of human in the loop as a constantly evolving flywheel of intertwining machine work with humans as support. It’s like a Rube Goldberg machine where we can intercept points of failure within the document digitization process.

Sipho Simela, Ocrolus:

That then turns into every story, and underwriting starts with good, clean data. You’ll hear that anecdote that you will get three different numbers if you hand three underwriters the same file. While interesting, that’s the part that we’re trying to get away from. We’re trying to standardize the process. As a result of having this high fidelity dataset, you’re now able to run some pretty complex analytics, including the income and the employment verification, the asset validation story. The way that we’re able to fit in as this implicit infrastructure makes us a really good partner.

Sipho Simela, Ocrolus:

We say if Ocrolus is doing its best work, nobody even knows that we’re there. So today, many of the top infrastructure FinTech platforms that sit out there, believe it not, actually sit on top of the Ocrolus infrastructure. So, more than documents to data. It truly is an entire flywheel that fits into either a mortgage process or embedded platforms inside of a mortgage.

Matt Levinson, Fintech Collective:

Fantastic. Thanks so much, Sipho. Jack, moving to you on this process of automating mortgage origination and underwriting. You guys are doing a lot in that space. So maybe some general thoughts on Plaid would be helpful and all the things you do relevant to this? I know that you’re most recently focused on income verification, which relates to what Sipho is just talking about with some of the documents like pay stubs and bank statements. We’d love to hear about Plaid, and then you’re a piece of the stack and in this theme.

Jack LaMar, Plaid:

Absolutely. I definitely agree with a lot of what’s been said. It makes me very excited to hear the focus on customer experience and this singular flow and a holistic view of the mortgage world and the consumer’s mortgage buying experience.

Jack LaMar, Plaid:

When we launched verification of assets in 2018, we considered it a very innovative time in mortgage technology. There were hundreds of new vendors. It was impossible to get a good booth at any of the conferences. There was a lot of focus there, but I think what got lost in all of that noise is a cohesive experience for a single end-user. We ended up talking to lenders, and we were like, “All right, what’s your technology stack?” It would be 30 different vendors. It would just be this huge list.

Jack LaMar, Plaid:

“We think this will work. We think this works here.” Then even going down to an individual loan officer, they would be using one provider, and they’d have a singular account with that. There was just a complete lack of consistency across the board. So I think what we see now is a desire to consolidate, simplify that process, eliminate these third-party touchpoints as much as possible for the borrower.

Jack LaMar, Plaid:

The borrower has a relationship with their loan officer and their lender, and each new person or vendor you introduce into that flow creates additional friction. Maybe it’s an additional conversation with the loan officer like, “What the heck is this email I got? Who is Plaid? Why is this company talking to me?” To Sipho’s point, I think a lot of what we see today is how can we inform and improve the process, but really from the background?

Jack LaMar, Plaid:

At Plaid, we don’t want to hijack the borrower’s conversation between a borrower and a loan officer. Our goal is to be a piece of a much, much larger puzzle and automate the things that should be automated while also still leaving room for that personal interaction. Like you said in your intro, it’s a major financial decision. Automation end-to-end might not be the best thing if you have a first-time home buyer or somebody who is stepping up to the plate with many questions. They could be scared off when they’re asked for 90 pages of PDFs and documents.

Jack LaMar, Plaid:

What we’re doing today and what we dipped our toe in the water with is our verification of assets solution, following the GSEs’ program with day one certainty and Fannie’s or Freddy’s program. We allow somebody to link their bank account and then eliminate the need for the actual manual document upload and have somebody submit that information digitally. To your point, it’s all consumer permission to your point, Nick, having this transparency and they know who they are talking to.

Jack LaMar, Plaid:

We very much want to be in that process, but in a very transparent, consumer-centric way. After a while, we jumped into the verification of income suite, where it was new territory for us and the mortgage world at large. Historically, we’ve had the work number and submit pay stubs, and those are your two options. Now, Plaid has built a way for us to connect to payroll providers and enable that same capability with bank accounts but using payroll.

Jack LaMar, Plaid:

I think the exciting part about that is as underwriting standards change. There’s a little bit more wiggle room for interpretation of income. These different calculations, compared to the rise of the gig economy and these other forms of employment that are actually very hard to underwrite, and most traditional models don’t understand how to interpret that. To Sipho’s point, data matters. Let’s get the data in the hands of the people that need to make these decisions. That way, at least all the information is on the table when trying to adjust to what the new normal is today.

Matt Levinson, Fintech Collective:

That makes a ton of sense. One of the reasons we invested in Ocrolus, as previously having been investors in Quovo, which got rolled into Plaid, we saw the evolution of what I’ll call the account connectivity and authentication stack primarily in bank accounts. We saw how far that could go, but also maybe some places where it couldn’t go as easily and where we’d be stuck with PDFs. When it comes to things like verifying income, which could require pay stubs, or underwriting alone, which could require tax forms, direct electronic connectivity to the IRS is really tough.

Matt Levinson, Fintech Collective:

Our thesis going forward is that there will be many opportunities for your two companies to work together specifically, and perhaps feed into Blend and ultimately make Nick’s life easier as one originator.