This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

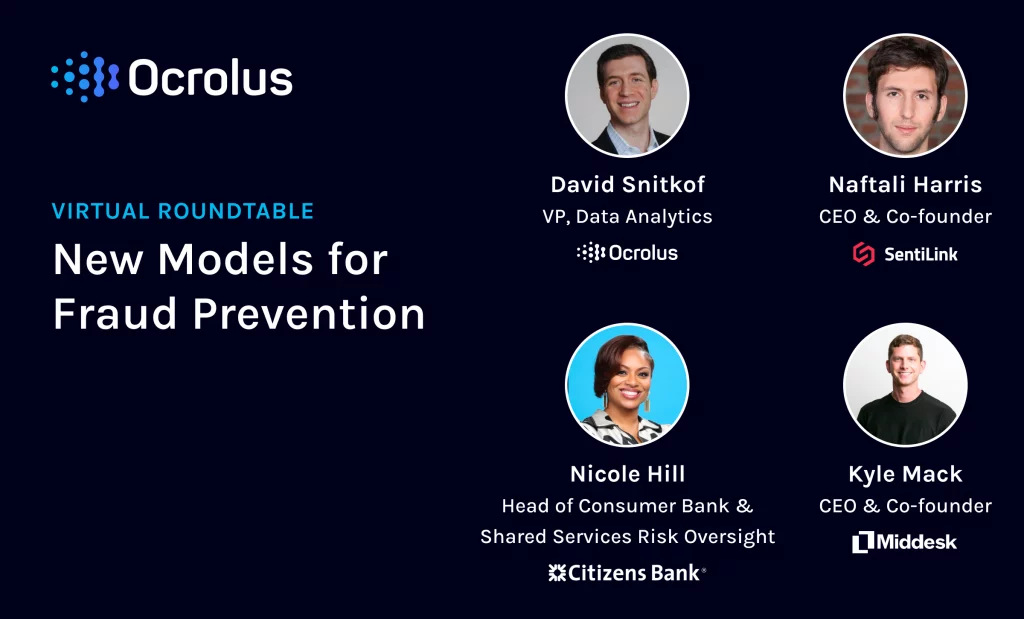

Virtual Roundtable: New Models for Fraud Prevention

Discover the issues, technologies and advanced methodologies that lenders need to understand to combat fraud detection and improve margins in an increasingly competitive marketplace.

WATCH THE COMPLETE DISCUSSION ON-DEMAND

Snippet of Virtual Roundtable Transcript

David Snitkof:

All right. So, fraud is in the shadows and so naturally people don’t necessarily have a great sense of how much fraud is out there and what types of fraud, and sometimes you talk to a lender and they’ll say, “Well, we don’t really have any fraud or we don’t have much fraud.” And you think, “Well really?” Assume people are saying that sincerely, why do they have that impression? Nicole, what do you think?

Nicole Hill:

Great question, David. So today with the type of fraud that occurs and Naftali can definitely speak to this, first party fraud has been eye-opening across not only financial services, but FinTech. And I think it just takes more collaboration on behalf of not only analytics, but also with risk partners, and fraud partners, and then really saying, “Let’s evaluate at the bottom of the funnel.” And what I mean by the bottom of the funnel is what’s not being paid from a collection strategy standpoint. And how can we start learning those opportunities by bringing in great partners like SentiLink to be able to screen scrape or scrap some of the things that we’re seeing in financial services and FinTech.

Nicole Hill:

So when you don’t see it and it ends up in the incorrect GL, or it’s in a collection loss GL, then you start to wonder why is that number in those buckets growing? And then that’s when you take that retro view and grab a SentiLink to say, “Hey, I need your help.” And that’s where… I actually worked really close to such a coincidence on this webinar. I worked really close with SentiLink at [inaudible 00:11:16] and it was where we had to really partner up and get actual scenarios so that we can say, “We do have fraud,” but this is different than what we’ve seen before.

Naftali Harris:

And I think exactly to Nicole’s point, one of the real challenges I think, especially with some of the more modern and sophisticated forms of fraud, is that unlike traditional identity theft, the new kinds of fraud don’t smack you in the face and say, “Hey, you have fraud.” I think they are a lot more subtle. If you look at synthetic fraud in particular, this is a case where you have someone that has invented a fake person and that fake doesn’t actually exist.

Naftali Harris:

And so, when they open up an account, borrow money, and then don’t repay it, there’s no consumer victim that’s going to come to you and say, “I was the victim of identity theft. Please, close this down and stop lending to someone that isn’t actually me.” Exactly to Nicole’s point, what ends up happening is it charges off and you try to collect on it and you can’t and if you don’t know what you’re looking for, then you’ll look at your fraud bucket and you’ll say, “I don’t have any fraud,” but of course you do. And it’s just in a different loss category.

Naftali Harris:

And I think, especially now as fraudsters have gotten more sophisticated and they’re starting new things, a lot of those tactics fall in that same category. I look at things like credit washing where people maliciously dispute trade lines off their credit reports, if you misstate your income, many kinds of first party fraud have that same characteristic where it doesn’t just show up and announce, “Hi, fraud is here.” And instead, it is a lot more subtle.

Kyle Mack:

I have to echo the points that Naftali made around fraud becoming subtle. We see this data from the commercial use case and one of the challenges I think on the commercial side is, the government is the steward of commercial data. They are the public record. And so a lot of the information around businesses is, in many cases, public. And then even more complex is that there’s actually a number of opportunities for commercial data to actually be edited directly at the government source by people who don’t own the information.

Kyle Mack:

When we’re talking about commercial applications, maybe as a three-sided problem of the applicant of an account and the business entity, and then trying to find a relationship between the two. It actually is fairly easy to build the relationship between an individual, whether that’s a real person or a fake identity and a business in the case that the commercial entity is actually a legitimate company.

Kyle Mack:

So yeah, I totally echo the idea of the subtleties of fraud and we certainly see it on the commercial side as well.

David Snitkof:

Are there fraud patterns and techniques that we’ve seen emerge recently that have only really taken place over the past couple of years?

Naftali Harris:

We’ve certainly seen some really interesting new forms of fraud, some of which are just so clever you have to ask yourself, “How did they even come up with this?” Like one, I just know this pretty funny example of this is, we’ve seen something that we’re calling same name fraud, it’s this phenomenon where, so for typical identity thefts, I would go find a data breach and I would steal everyone’s identity. So for example, suppose I stole Nicole’s identity, well, one of the challenges I have stealing Nicole identity is, when I get asked for a driver’s license or something like that, I’ll have to create a fake driver’s license that has Nicole’s name on it, and date of birth, and yes, it’s possible to create fake driver’s licenses in some cases, ones that are pretty good, but it is challenging.

Naftali Harris:

And so what we’ve seen instead with this same name fraud is, somebody whose actual name is John Smith will go and steal the identity of everybody else whose name is John Smith. And you’ll be able to use a real driver’s license and it ends up manifesting itself in the data in a pretty interesting way. Or you ended up with a whole bunch of people whose name is John Smith that all apply at the same time and all use the same address, and you’re like, “What is John Smith from Vermont doing, applying the same day as John Smith from… Did we advertise it at John Smith convention or something like that?” But, it really happens and it’s a really crazy and fascinating fraud that we’ve seen. [crosstalk 00:16:00] crazy example. Yeah.

Kyle Mack:

You always have to sympathize with the person whose name is truly John Smith.

Naftali Harris:

I know, I know. If there’s any John Smith on the call today, I apologize. I wasn’t talking about you in particular.

David Snitkof:

It’s good to have a fraud-proof unique name.