This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

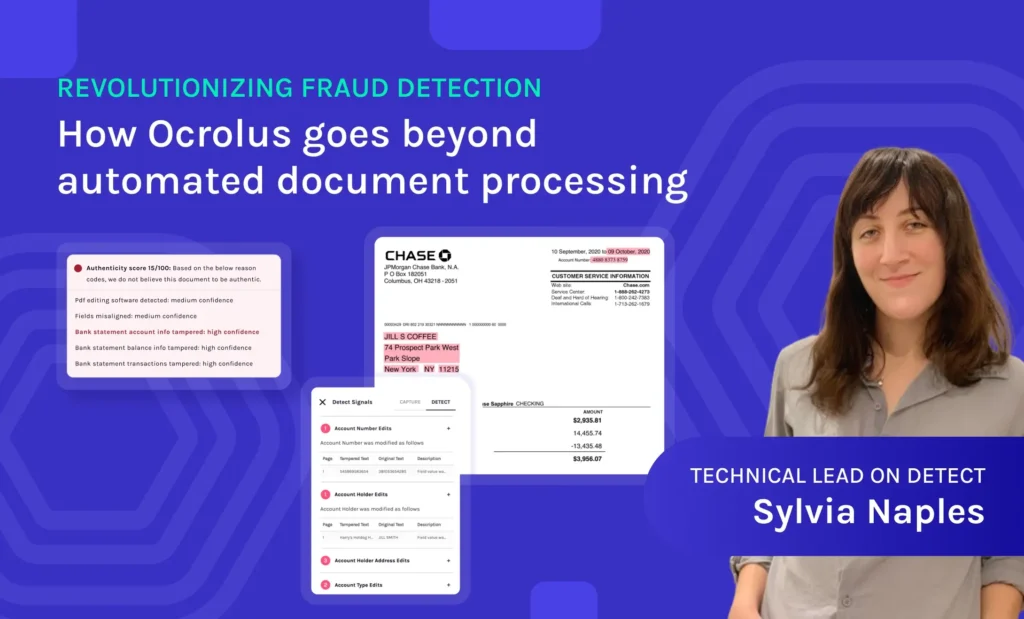

Revolutionizing fraud detection: How Ocrolus goes beyond automated document processing

The digitization of documents has transformed how businesses operate, particularly within the financial sector, where accuracy, speed, and efficiency are paramount. Automated document processing solutions like Ocrolus enable lenders to accelerate reviews and scale on demand. However, in an increasingly digital environment, fraud has also accelerated, leading to significant losses if undetected, making accurate fraud detection an essential component of automated document processing. Techniques such as using online template generators to create artificial documents and tampering with authentic documents to misrepresent information have become increasingly prevalent.

At Ocrolus, our goal is to enable lenders to make decisions quickly and confidently at scale. With a vast database of financial documents and unparalleled accuracy in capture and analytics, we are uniquely positioned for fraud detection. After evaluating external solutions, we realized that not only could we offer something stronger by solving the problem internally, but we also gained the flexibility to tailor our products specifically to our clients’ needs, ensuring they derive maximum value from our solutions.

Ocrolus is uniquely positioned to combat potential fraud

Extensive database and superior accuracy

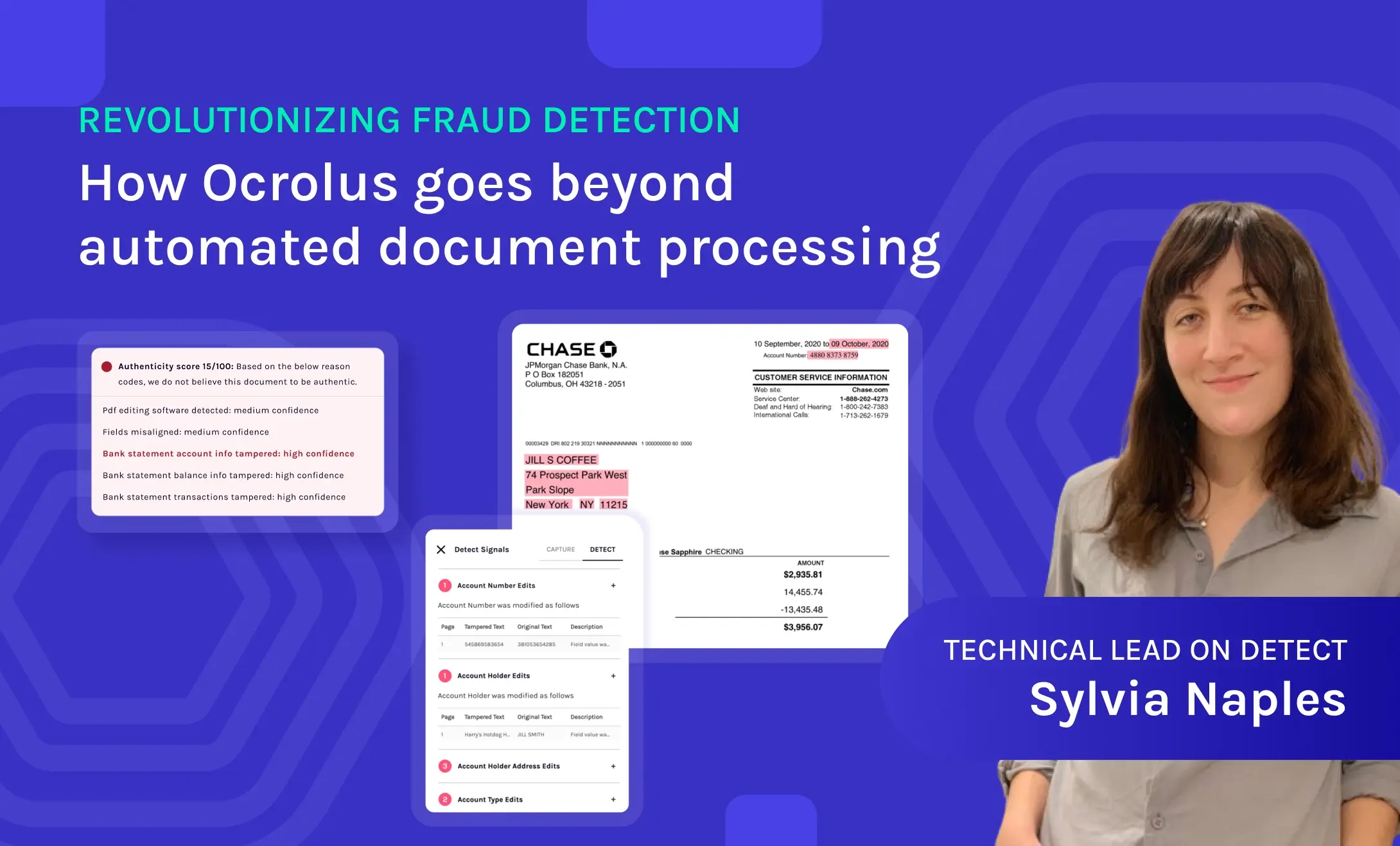

Ocrolus boasts an extensive database of financial documents and best-in-class accuracy in data extraction. Our unique infrastructure combines cutting-edge AI with human-in-the-loop review, making us leaders in data extraction. This reliability allows us to integrate context into our detection signals. Our API and dashboard capabilities offer detailed indicators of exactly which fields have been tampered with, and context is weighted into our cumulative score for ease of decision-making and workflow prioritization. For instance, there’s a different level of risk if a single transaction description is modified compared to if identifying information such as name, address, or account number is altered.

Advanced validation checks

Our extraction capabilities also allow us to provide validation checks on images not available in other solutions in the market. A leading example of these capabilities is address validation on e-pdfs and image documents. Addresses captured from bank statements, paystubs, and W2s are verified, helping identify generated templates and tampered documents. Ocrolus performs standard fraud detection checks, such as detecting the use of image editing software. However, what sets it apart from other solutions is that we can leverage our accurate field extraction to perform many other otherwise impossible checks possible. In addition to address validation, we also perform algorithmic checks that look for arithmetic anomalies.

Document fingerprinting

In part, we owe our extraction accuracy to our extensive document collection, which enables us to offer document fingerprinting — a positive indicator of document authenticity. For top banks such as Wells Fargo, Chase, and Bank of America, we can confidently confirm if the document origin is authentic using detailed checks. A confirmed document origin, paired with no signals of tampering, indicates very low risk and can be processed confidently.

Ocrolus’ commitment to accuracy

At Ocrolus, we prioritize accuracy. It’s crucial that our clients, primarily operating within the financial services sector, can trust our results. While we offer expanded signals for well-known banks and payroll processors, our fraud detection capabilities are institution-agnostic: we are equally successful at detecting fraud in both large and small banks and payroll processors.

We prioritize accuracy and reliability in several ways:

- Signals undergo extensive testing and analysis before integration to guarantee quality.

- A comprehensive monitoring system ensures our performance always meets the highest standards.

- Reducing false positives to decrease manual review and minimizing false negatives to reduce risk. Our goal is not to achieve 100% true positives but to avoid missing potential fraud, which can be costly. However, we consistently track and minimize false positives as much as possible.

Thanks to our integrated processes, our true positive rate consistently hovers above 90%. We review a random sample of documents flagged by Detect daily to determine ground truth. This ground truth labeling allows us to monitor accuracy, improve our models, and flag potential false positive patterns for research and development. False positives and false negatives are collected from client reporting for similar analysis and future development.

Additionally, we monitor hit rates, segregating by details such as bank name to identify and resolve any issues causing false signals.

Client satisfaction is our priority

Ocrolus’ fraud detection solution is designed for ease of use and enhancing efficiency, and it is shaped by client feedback. Our signals are easy to interpret and highly correlated with fraud; noisy signals don’t serve to reduce manual review and can lead to a sense of discomfort on how to proceed. The majority of our signals include context and interactive visualizations.

In the dashboard, custom filters allow prioritization and workflow optimization. Our dashboard and API are designed to enable users to make decisions quickly and confidently. Ocrolus’ Detect Authenticity Score distills down our signals into a single easy-to-read score, and accompanying reason codes offer a high-level overview of findings, allowing custom workflows via the API and dashboard.

Commitment to innovation

We have led the way in innovation, constantly expanding our capabilities, integrating client feedback and priorities and finding new ways to leverage the latest technologies. Our capabilities are well documented publicly, which means other solutions are often trying to follow in our footsteps, but we still have a lot of exciting advancements ahead.

Book a demo today if you want to learn more about how intelligent document automation and fraud detection can help your team more effectively mitigate fraud.

Key takeaways:

- Lenders in the increasingly digital financial sector require accurate fraud detection in automated document processing to avoid significant risk and financial losses.

- Ocrolus’ extensive database, best-in-class accuracy, advanced validation checks and document fingerprinting capabilities uniquely position us to help financial services teams effectively mitigate fraud.

- Our fraud detection solution is designed for ease of use and efficiency and is shaped by client feedback. It includes customizable workflows to help users make decisions quickly and confidently.